Tankers - A free report

We recently did a report on crude tankers, I'm letting you have this one for free

Last week my company interviewed Lars Barstad, the CEO of Frontline. I know it’s a public company CEO’s job to be bullish, but even I was surprised by just how bullish he was. Here is a quote from the 40 minute interview we did.

I wouldn’t be too concerned about the order book. There still haven’t been enough orders to even replace the aging fleet…The market has been strong…but owners won’t take out their pens and write checks until we see that really insane market…

Lars Barstad, CEO, Frontline

Out of all tankers, the order book still isn’t really replacing the ships that are too old to get hired for modern trade. We do know that a lot of older tonnage is being sold for the Iranian, Venezuelan, and Russian trades, but there are limits to how many old ships can be trading, just as there are limits to how many ships can be on those trades.

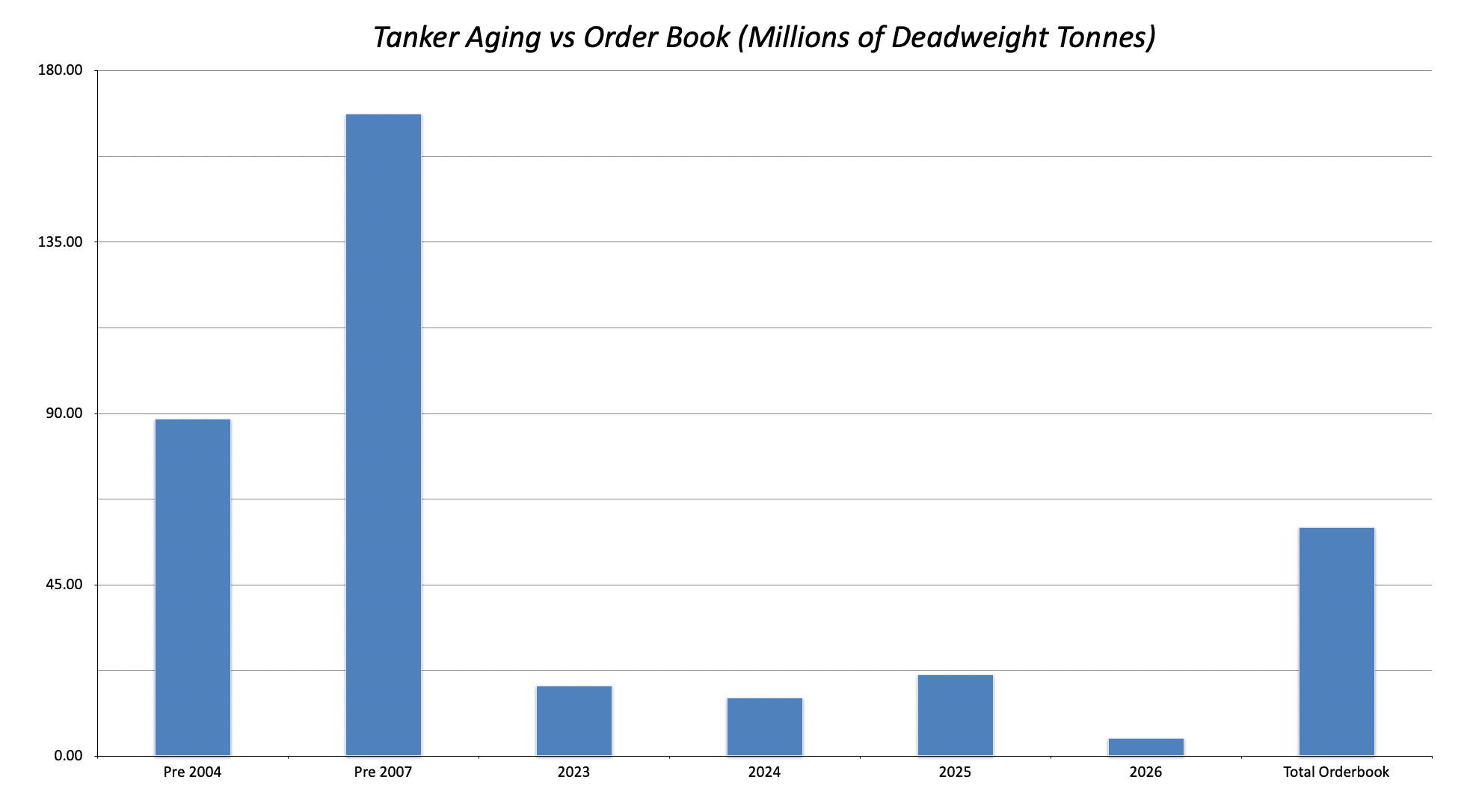

Of all the order book profiles, the tanker order book continues to appear the most attractive by far. Here’s a look based on Marhelm data that confirms what Mr. Barstad was telling us:

As you can see, the total of the order book isn’t enough to even replace the ships that are already twenty years old. The order book would need to more than double in order to replace the ships that will be 20 years or older in the next four years.

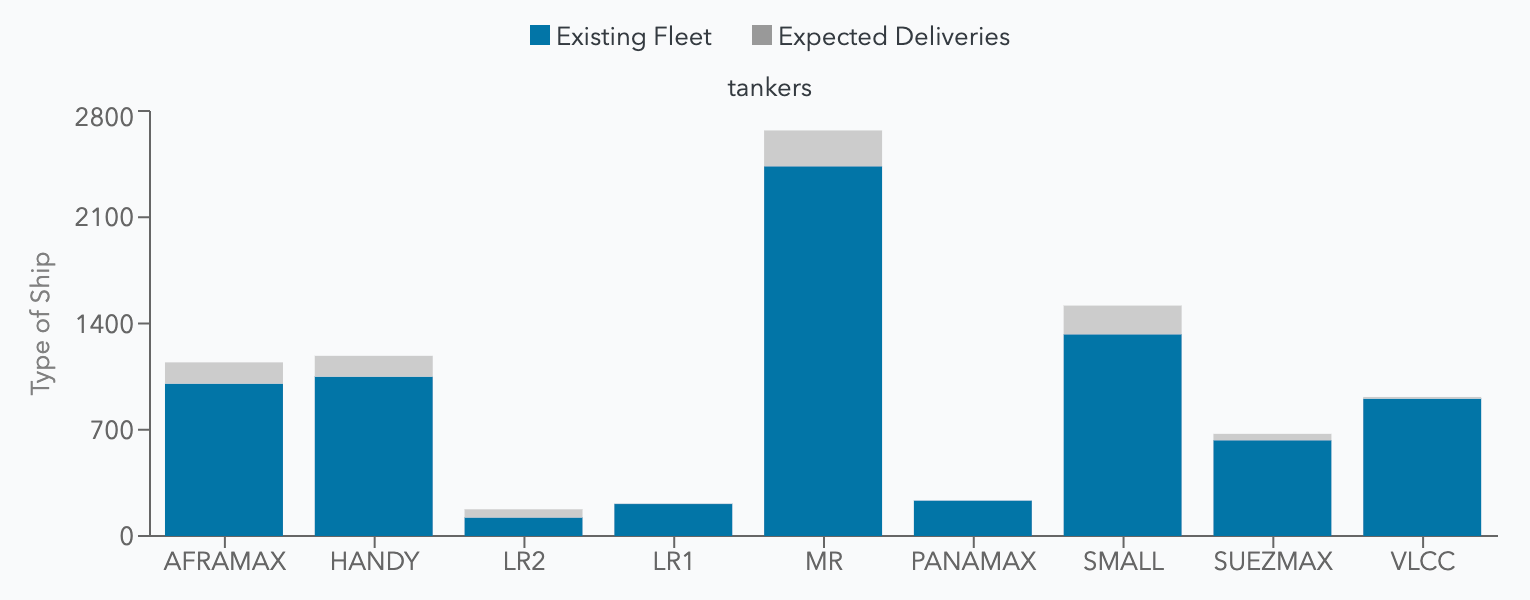

When you look at particular asset classes, you start seeing even wider divergences. The order book tells me that the VLCC and LR1/Panamax sectors have virtually no ships on order. The Suezmax order book is also quite thin. LR2s, Aframaxes, and smaller product tankers have the greatest percentage of the fleet on order.

The net/net here is that crude tankers - especially the VLCC and LR1/Panamax segments - continue to look extremely structurally bullish. Let’s take a look with a focus on the VLCC sector.

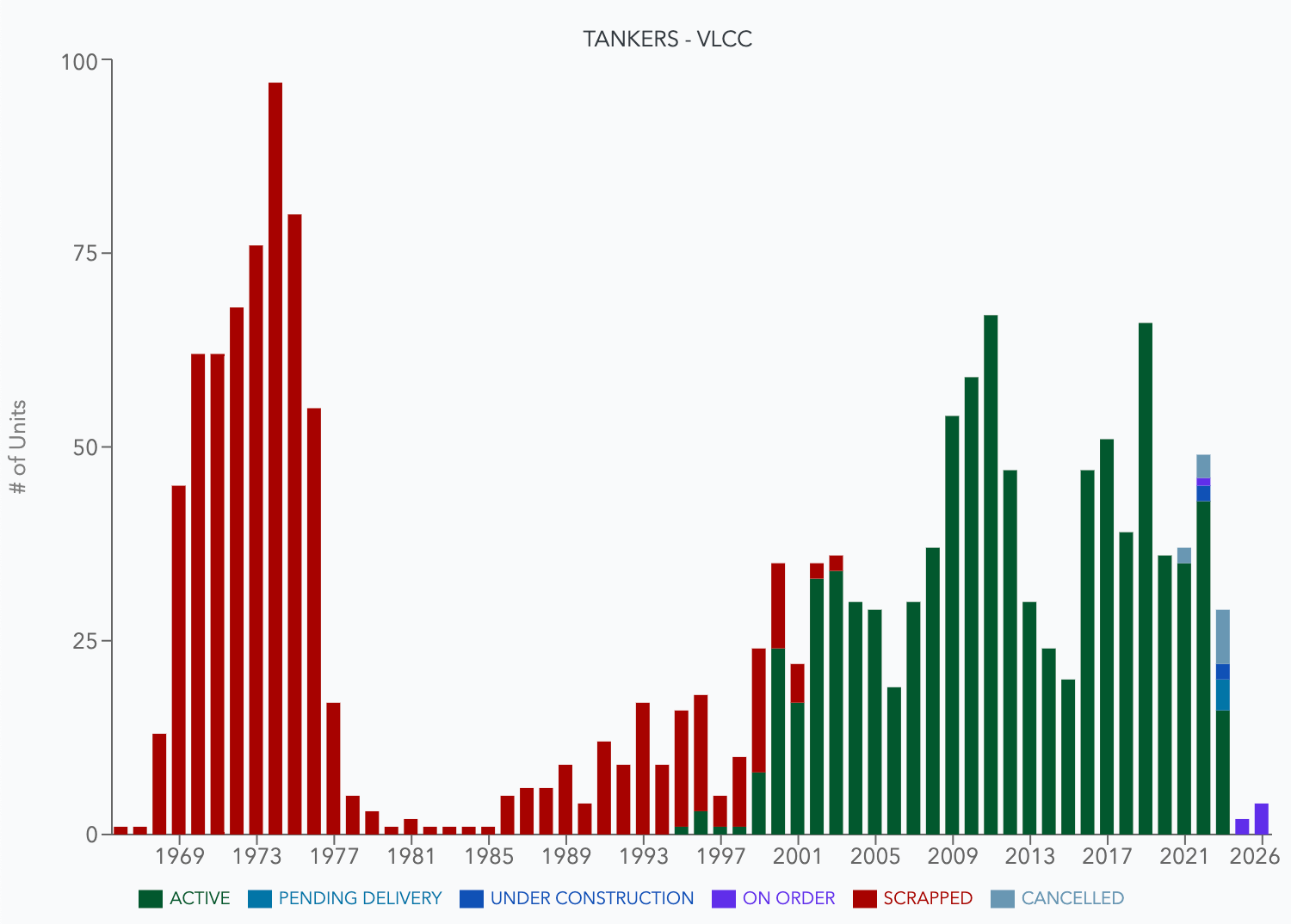

What we find is that not only has there been a bit of order book slippage, there is literally nothing on order for next year, and very little on order for 2025 and 2026. Another thing Barstad mentioned is that there have been so many orders in other segments that ship yards are running out of capacity before 2026. That’s three years from now. Three years is an eternity in shipping.

If tonne miles just hold - they don’t even need to expand - VLCCs could have one hell of a run. Going back to what Lars said - you really need that “insane” market” to get a lot of ordering. We got a lot of ordering in the lead up to IMO 2020 (note all the 2019 deliveries) as it was assumed IMO 2020 could make super tanker rates go crazy. The super contango pulled in some more orders. But we can see that the last truly crazy ordering sprees were during the Suez Canal crisis 50 years ago (the beginning of the super tanker age) and during the mid-late 2000s following the double hull tanker change over.

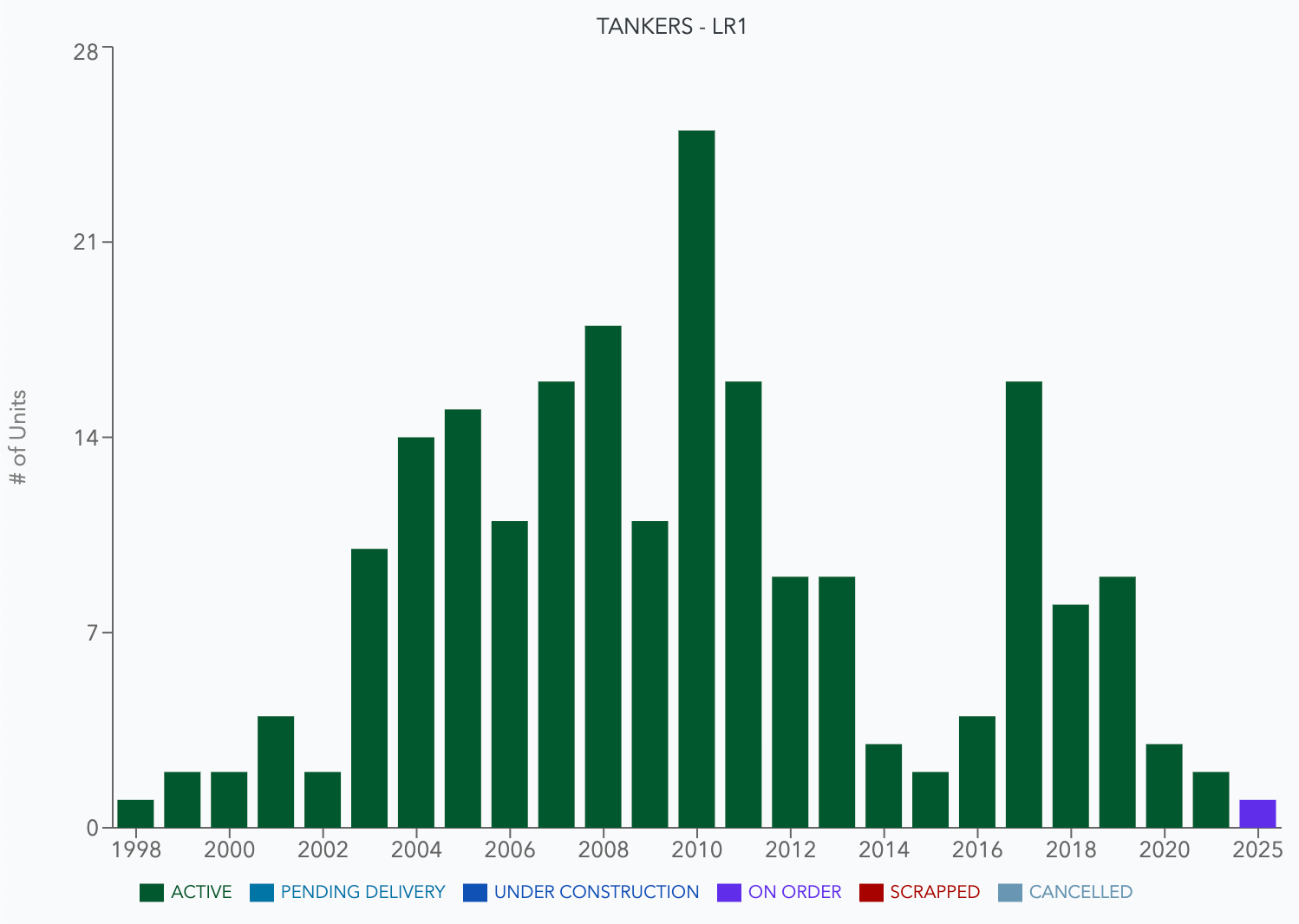

Looking at the Panamax/LR1 segment, we see a similar story. There are no Panamax crude tankers on order. The LR1 segment has the lowest number of ships on order since 1998. And if you’re looking at the Marhelm rate updates every day - most days Panamaxes are earning more than any other ship types.

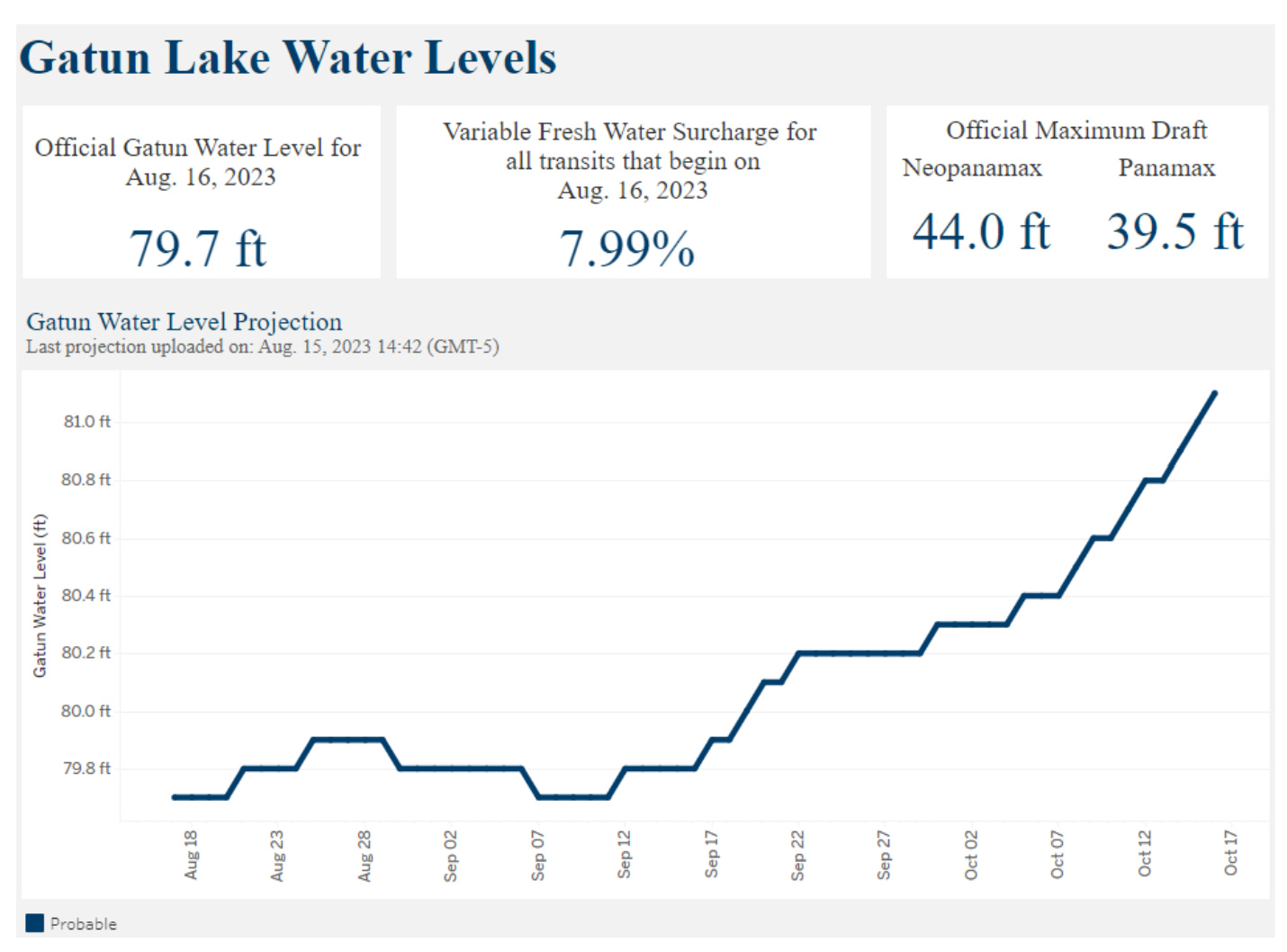

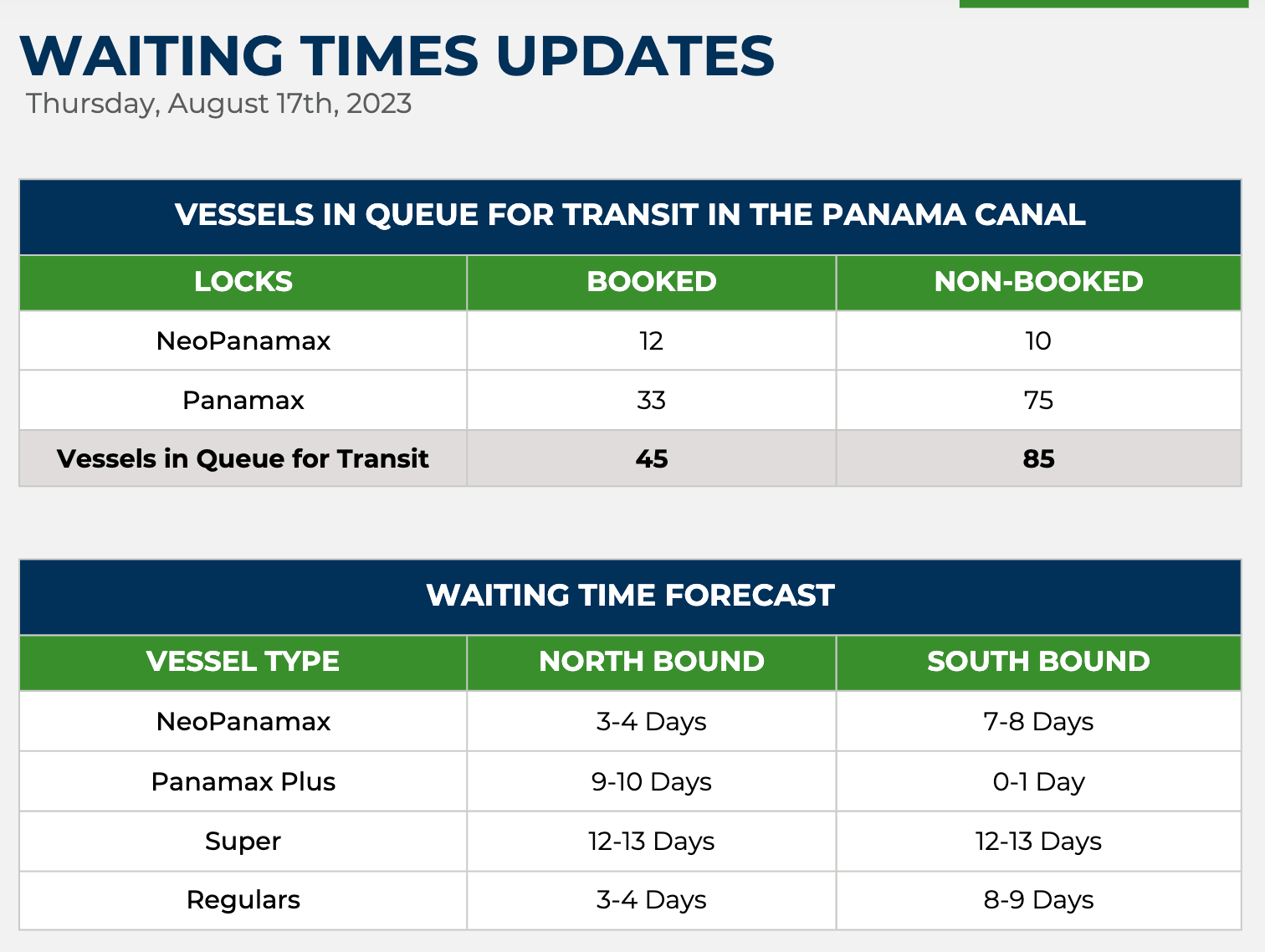

The Panamax segment has one other big thing going for it - the Panama Canal. While it’s extraordinarily bad for Panama - it’s already resulted in a 20% drop in recent tonnage transits and has resulted in severe congestion - it’s very good for Panamax plus tanker rates. The only way the Colombian, Venezuelan, Guyanese, and Brazilian crude can make it to the west coast without going around South America - adding weeks to a typical voyage - is the Panama Canal. The issues with the canal may be structural, and could provide strong support to the sector for years to come.

Looking only at fleet composition, I would say that DHT (VLCC pure play), Euronav (VLCC/Suezmax), Okeanis (VLCC/Suezmax), INSW (Heavy VLCC/LR1 exposure) and Hafnia (Heavy Panamax/LR1 exposure) have the most attractive fleets.

Marhelm recently completed a crude tanker - and separately a product tanker - special report which goes into the relative pros/cons and valuations / return policies of every company in the sector - but the above - in my view - are all very attractive. I personally have exposure to DHT, Okeanis, and Hafnia.

Conclusion

While investors are always rightfully wary of any surge in shipping stocks, tankers - and especially the VLCC and Panamax segments - are in a very unique place historically.

Because of the constant table pounding on decarbonization, owners have not really responded to the surge in earnings how they typically would - get drunk and order ships till they pass out.

Due to the very strange market after covid (and historic container congestion, especially) and the challenges around LNG and Russia - all of the other segments have filled the order book so that tanker orders for any meaningful amount of tonnage are at least three years out.

Barring a collapse in crude oil production and exports, this is the sort of structural setup that only comes along once in a generation. Several companies (Hafnia and Okeanis were my top bets) are still offering double digit yields, and things could get better.

I remain long, despite having accumulated a 3x gain on Hafnia and a more than 6x gain on Okeanis. This market can keep going.

Want to get the full sector reports?

Send an email to sales@marhelm.com or request a demo on our website. You can also reply to this post. If you’re a paid blog subscriber, we’ll discount everything you’ve paid on the blog so far on your first payments, which could mean you get a month or more for free.

Marhelm combines information, community, trade ideas, and customer support in a way that no other platform on earth does and has been hailed as “the best financial decision of my life” by many subscribers.

Demos are free, and you can discount the blog fees you’ve already paid. Check out the platform, send us a demo request. There’s no risk in learning more and you just might avoid costly mistakes and identify new opportunities.