Either I'm dumb or the world has lost its mind

Putting the MAG7 stock craze in context, examining how much they can actually grow

META is up more than 20% on the announcement that they will pay what amounts to a 0.4% dividend and buy back ~5% of shares outstanding (now 4% after the move of every fund manager on earth front running).

I’m sitting at my desk in Argentina, where I’ll be for the next 5 weeks, trying to make sense of how I’m down more than 3% on the day (and 6% on the year) while 7 stocks seem to do nothing but go up no matter what happens. Higher yields? Mag7 up. Powell says no rate cuts? Mag7 up.

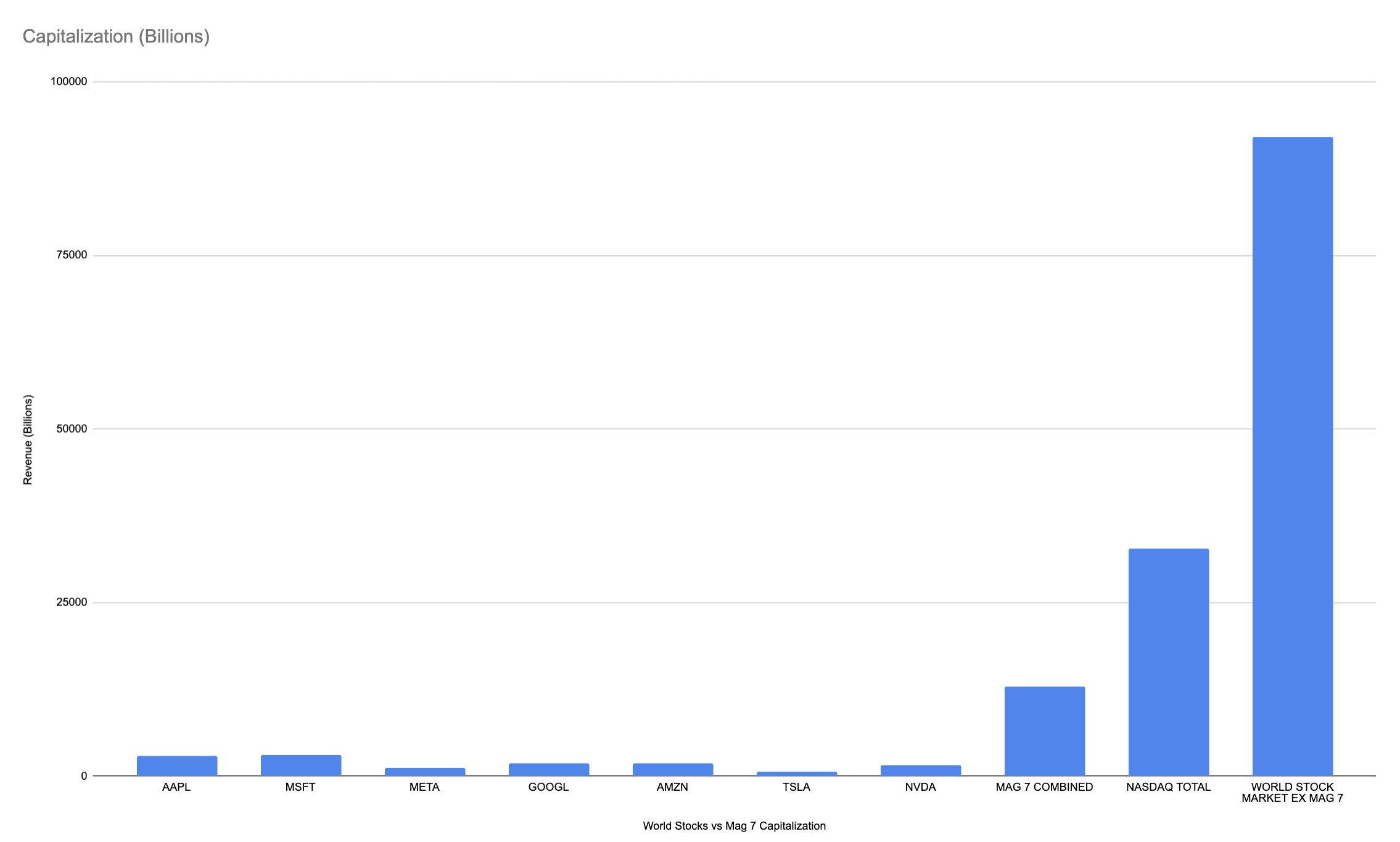

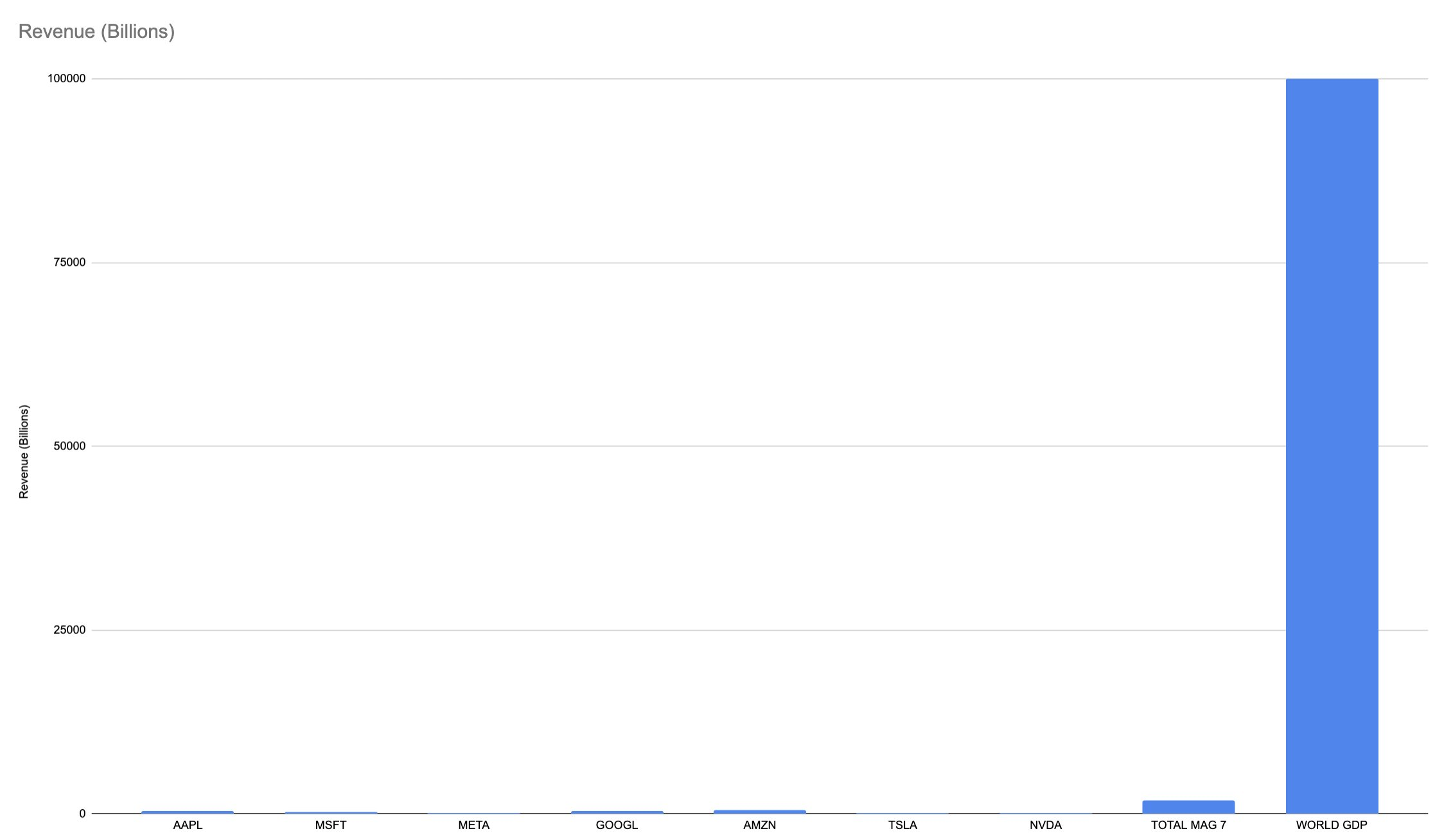

Maybe I’m just an idiot, but I still just can’t figure out how everyone else seems to come to the conclusion that these 7 stocks should be worth 1/6th the value of every other stock in the world combined. Yes, you read that correctly. The total stock capitalization for every stock on earth is only about $100T. Mag7 is 13% of that total. Interestingly, world GDP is about the same at $105T. In other words, we can use world GDP and work stock capitalization interchangeably.

MAG7, while grossing an estimated 3% of global private sector revenue and 1.7% of global GDP (includes government spending), makes up 1/6th of the total world stock capitalization. The implication here is that either the world economy will grow enough to justify the valuations of these companies (as growth will continue), or that these companies will continue to get a larger share of the global pie.

But how much of the pie can these companies get? Let’s step back and think about what these companies do again:

AAPL - Consumer electronics and computing

MSFT - Cloud and software/computing (about half business, half consumer)

NVDA - GPUs/CPUs

META - Advertising / entertainment

GOOGL - Advertising/Cloud

TSLA - Cars

AMZN - Cloud/data centers / consumer shopping

Now I know there is some nuance there (Amazon bought whole foods, META and AAPL are doing virtual reality), but those are the broad strokes of revenue concentration. If we look at each revenue center, we can think about what can really grow.

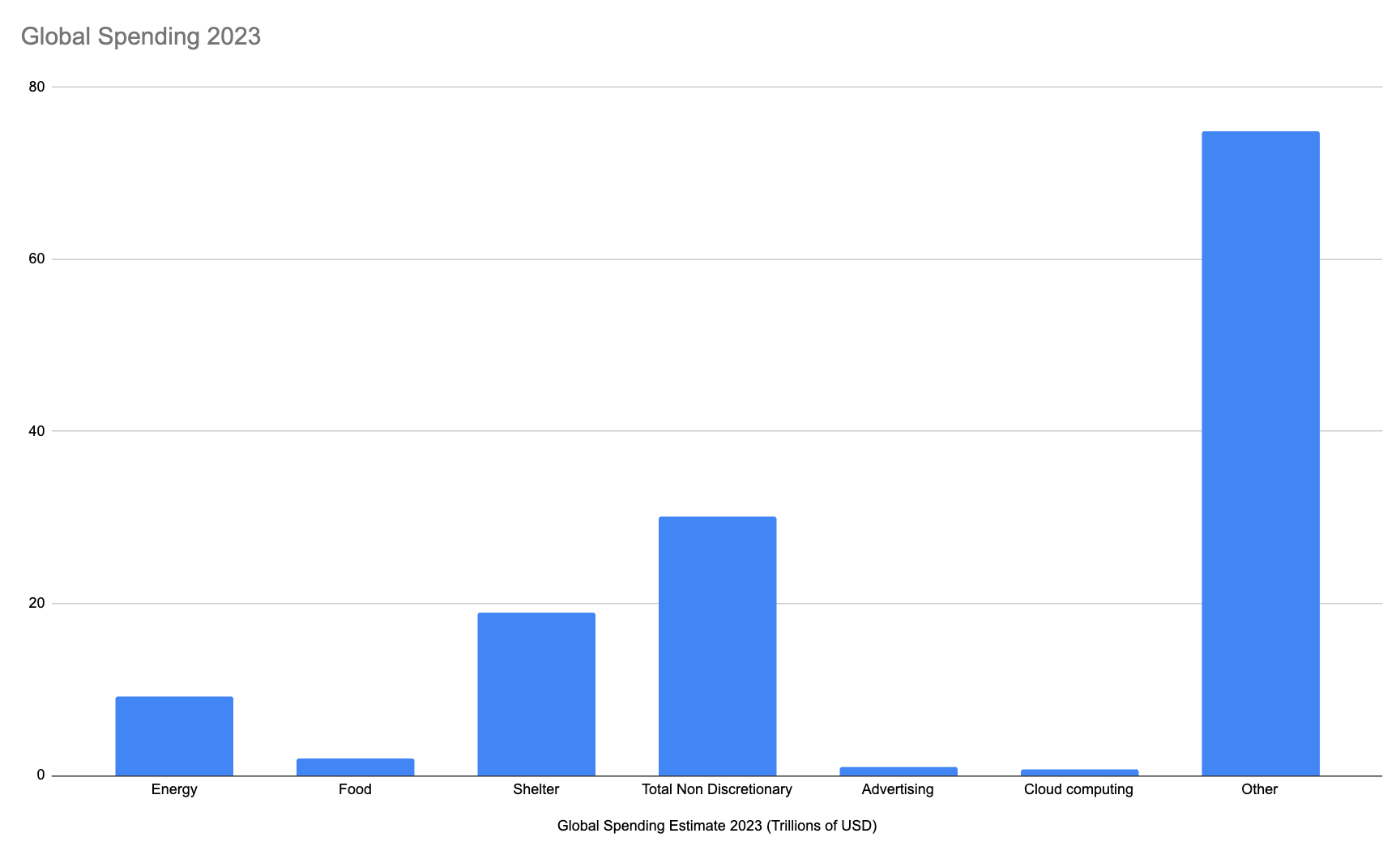

What all of these companies have in common is that they all sell discretionary products. While a tiny percentage of the revenue for each of these companies is supporting the non discretionary economy (actual critical infrastructure), nobody needs these companies to live. Let’s compare the size of the global economy that people need to live, call it food, energy, and housing, with everything discretionary.

Essentially a third of annual global spending goes into energy, food, and shelter. The last time I checked, none of the above companies own any mines or oil fields. In my estimates, I’m not even including infrastructure spending, social services, healthcare, or anything else. The only things I’m including as “non discretionary” are energy, food, and shelter.

Most governments are spending most of their portion of GDP on social services. They are doing it at a loss. Most governments around the world, including the United States, are running deficits. Only a few governments do not allow deficit spending. Which of the MAG7 companies is going to provide for all the future retirement obligations of billions of people? Which will feed the hungry? Which will build roads?

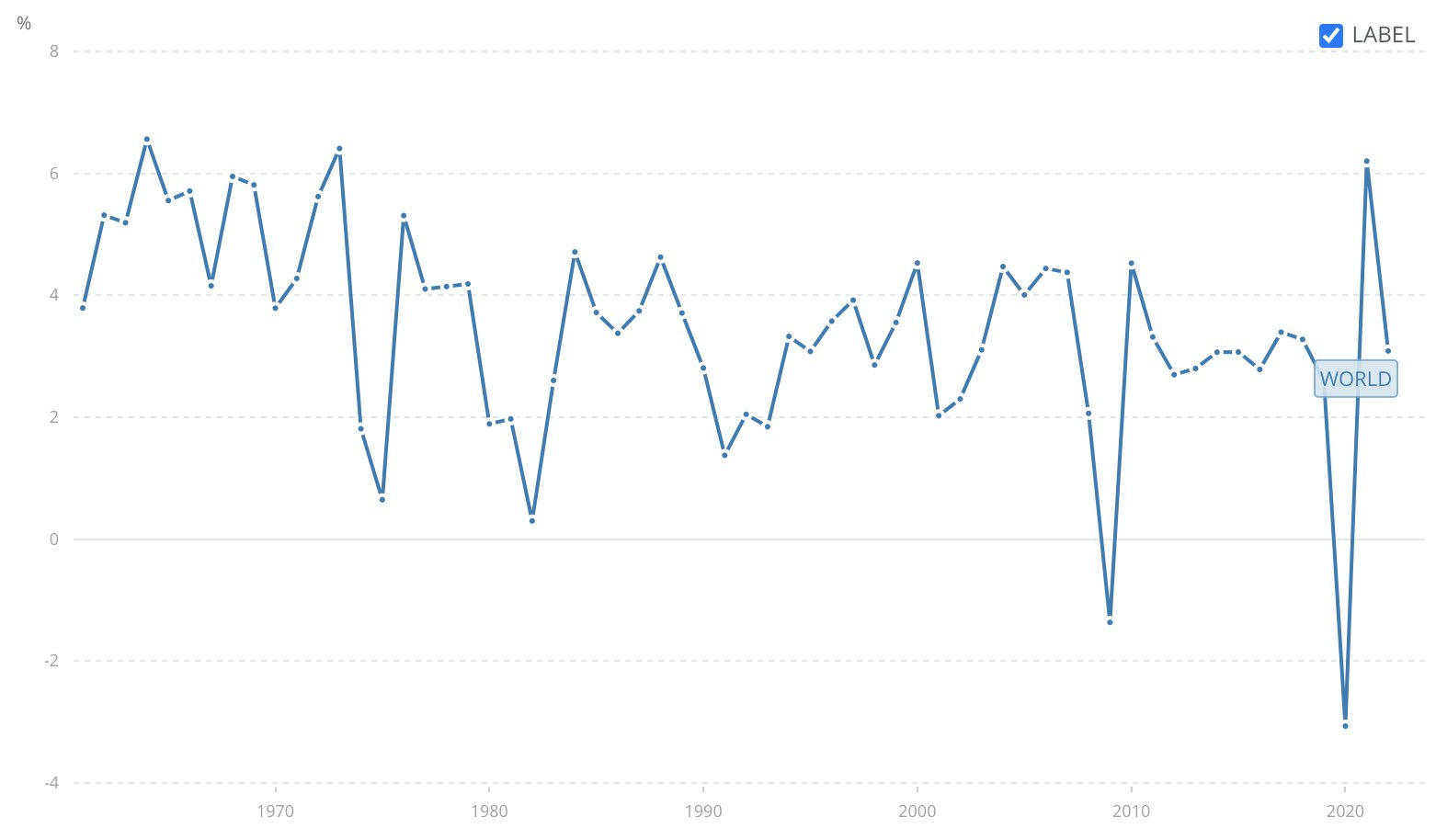

When you really dig into, the theoretical global market size for a group of private companies that serve non discretionary needs, is maybe 40% of world GDP. This is approximately 25x the total amount of revenue that MAG7 generates. However, the capitalization of these companies is already ~7.5x revenue. The global economy isn’t a zero sum game, but it’s close to one. Average growth rates are only ~3% per year and falling.

If you extrapolate growth rates, the entire global economy can only grow by approximately 34% over the next decade. Since world growth can’t deliver a justification for MAG7 valuations, that means you have to believe that MAG7 companies will get a bigger share of the pie than they already have, or that their categories in the pie will soak up every marginal dollar.

In my view, at a $32T capitalization, the Nasdaq already sucks up most of the global marginal dollars. 7 stocks make up 1/3 of the total capitalization for the Nasdaq. Will MAG7 companies put all their competitors out of business? How? They are already, amongst themselves, competing for some of the same dollars.

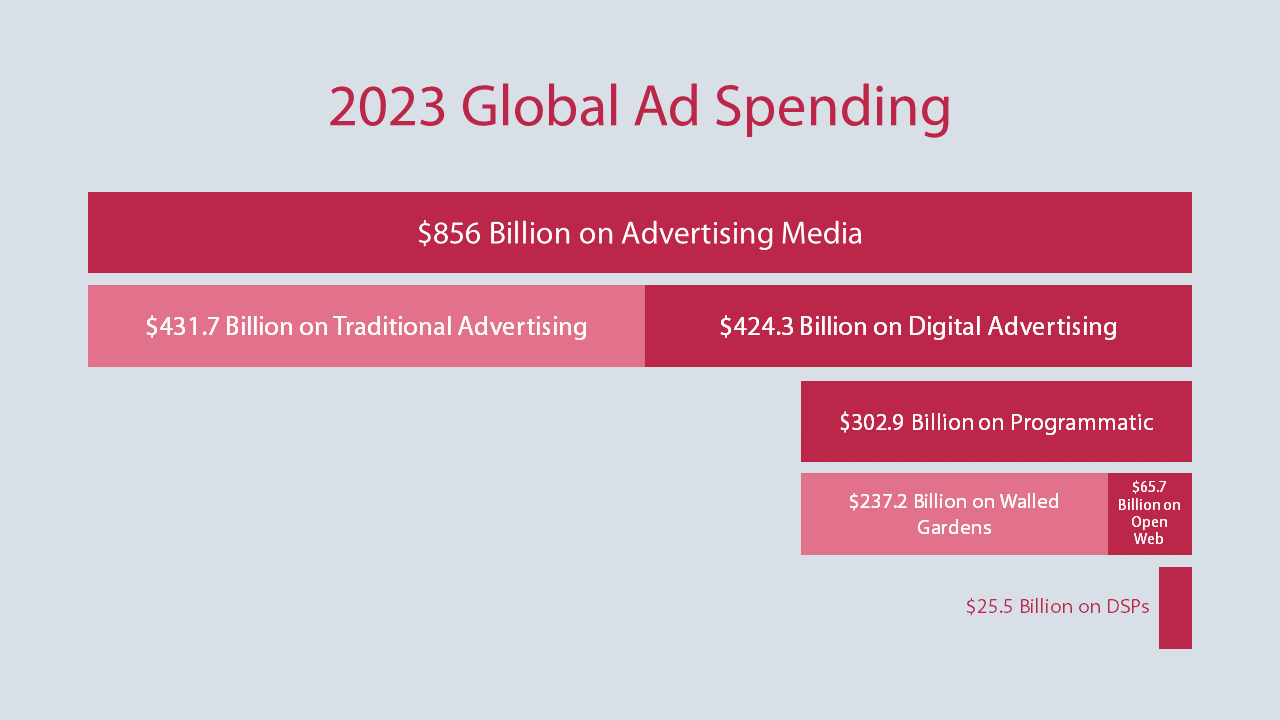

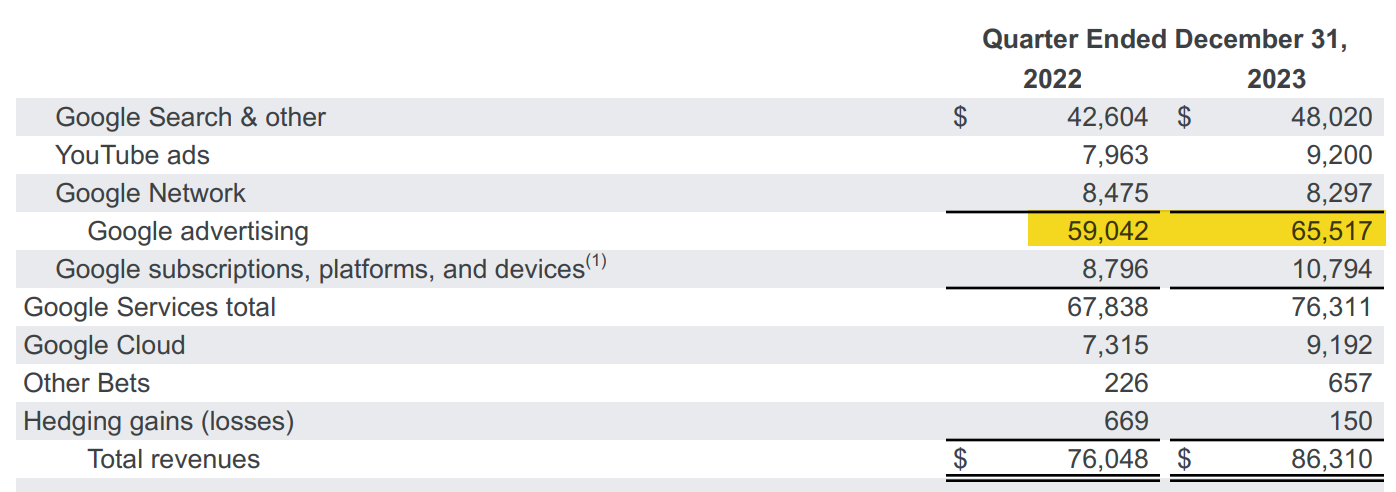

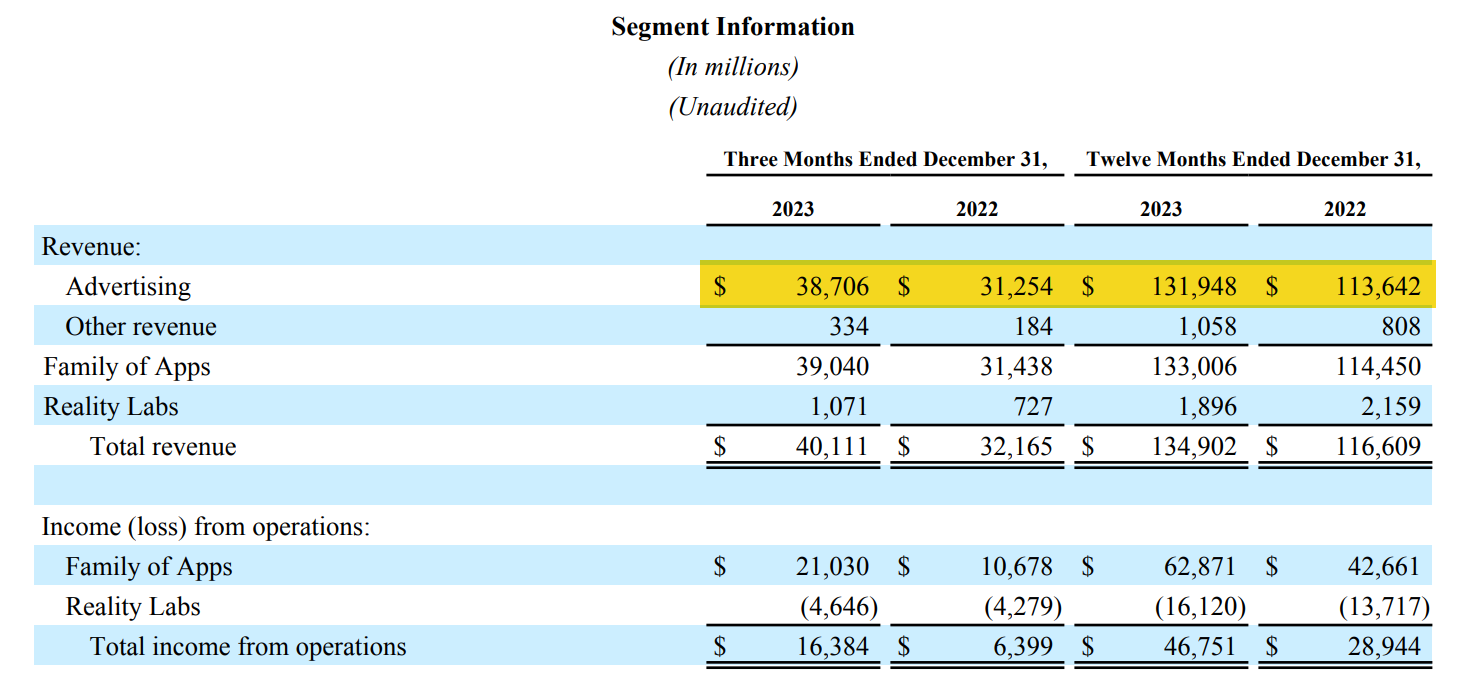

GOOGL and META are both competing for the same ad spending market. If you do the math, combined, they do nearly $400B in revenue. Both of these firms are essentially advertising companies. It’s Google’s cash cow. It’s essentially Meta’s only source of income.

If both of these companies were to essentially take the rest of the advertising market (the half that they don’t already own), they have a high margin trillion dollar revenue stream. Perhaps they have some pricing power. Perhaps they can make others pay more for advertising. But they will still need to compete with each other, and they are still, like it or not, 100% dependent on ad spending from customers who must have sufficient profitability to pay them for ads.

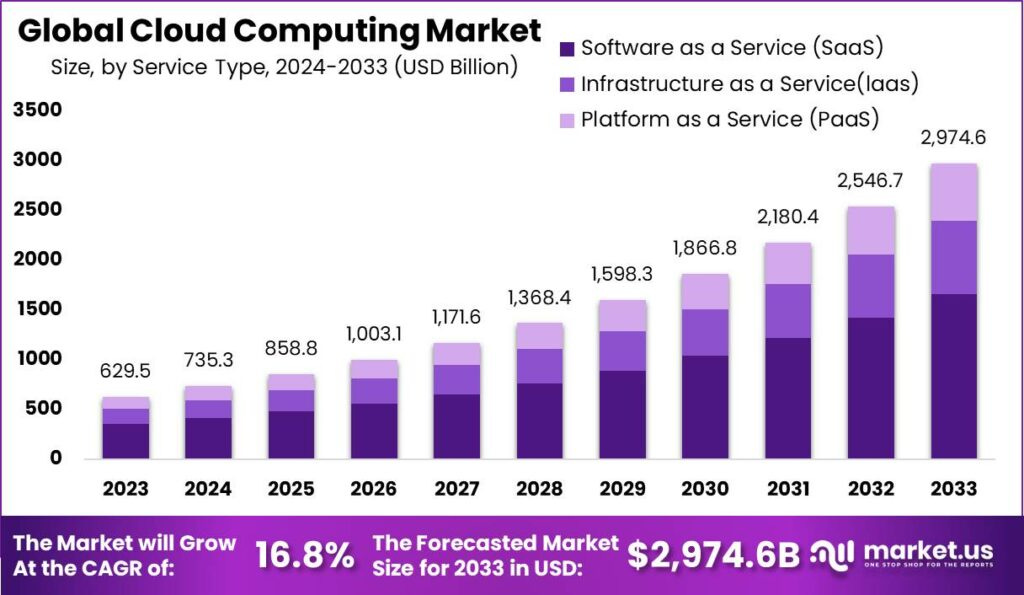

The other major theme these companies are exposed to is data centers, which granted, is a segment which has strong forecasted growth ahead. However, it’s currently much smaller than the advertising pie, though the CAGR forecast over the next decade is ~17%.

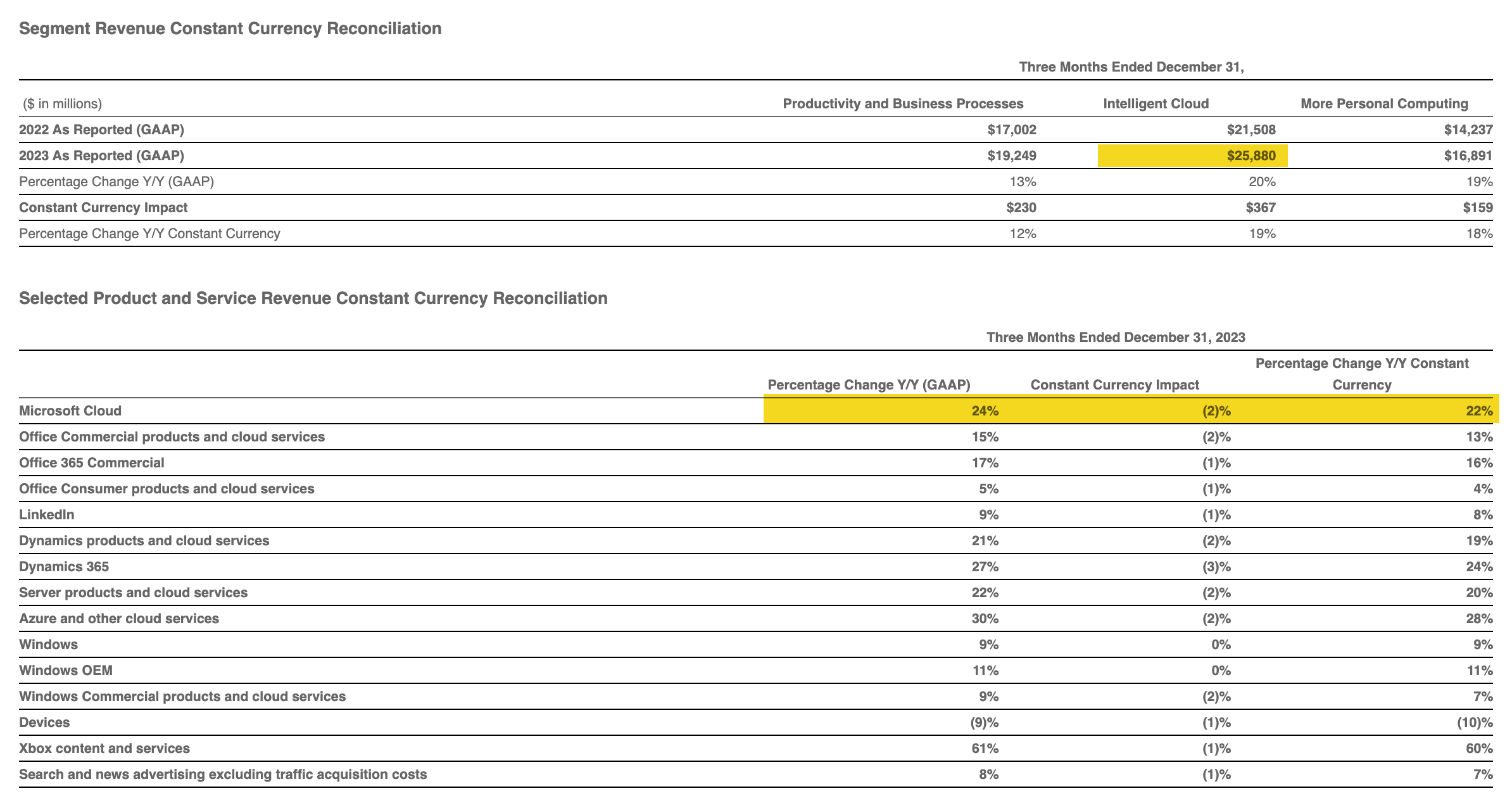

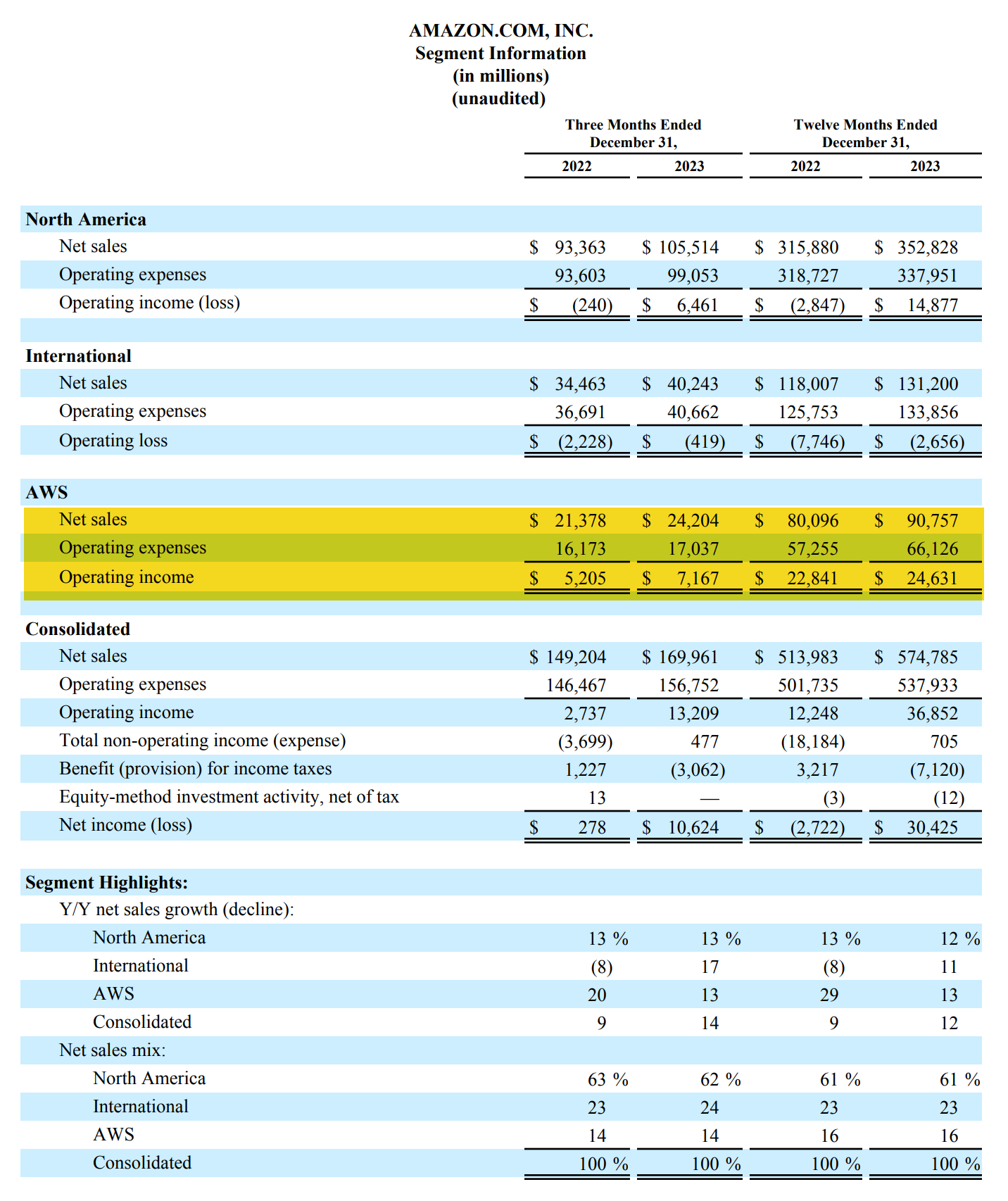

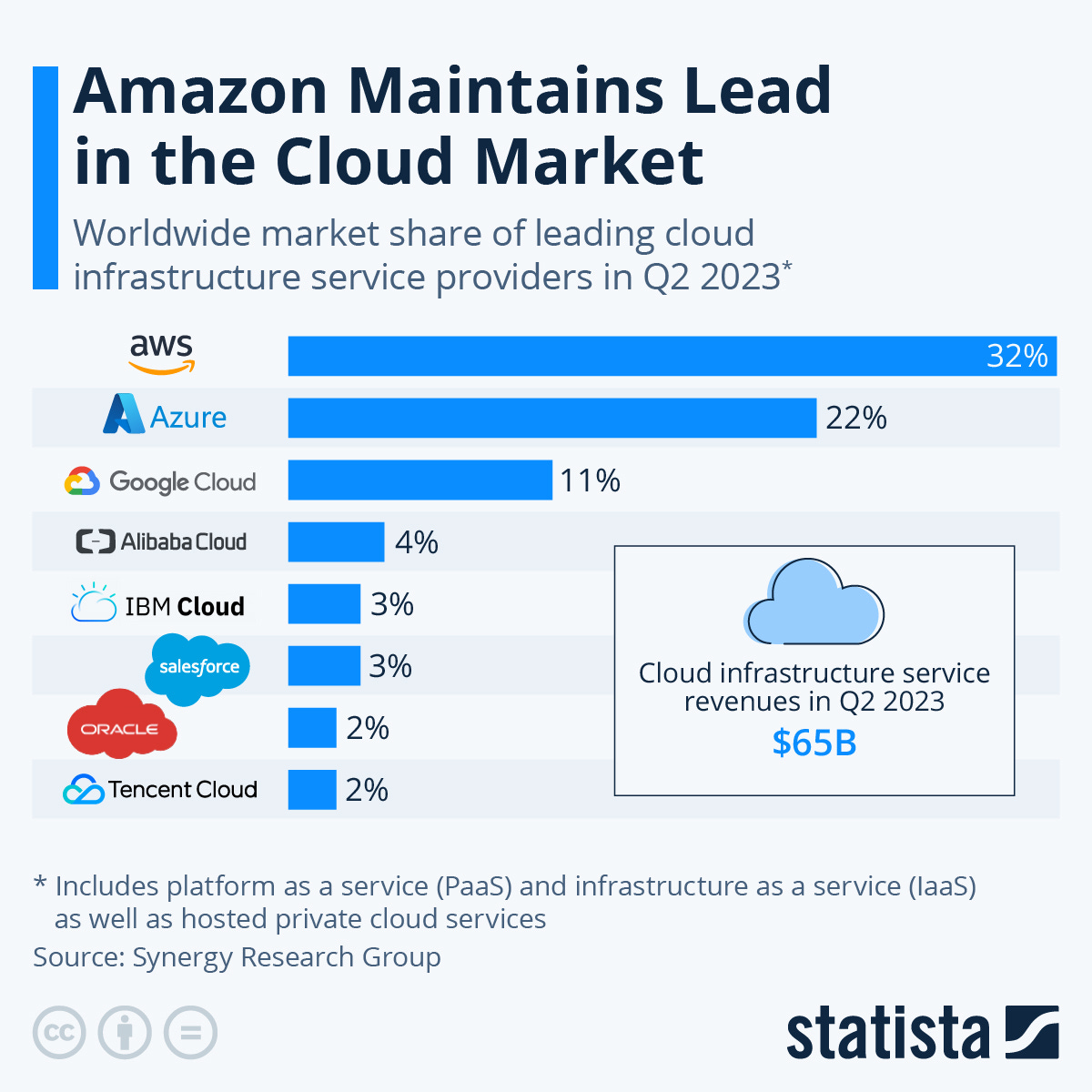

Microsoft and Amazon own a huge percentage of the data center as a service market already. Combined they are what, most of the IaaS (basically servers for rent, AWS and Azure), much of the PaaS markets, and a decent chunk of the SAAS market?

This market will see a lot of growth - let’s say it’s 0.6% of global GDP now and will be 2% of global GDP in ten years, but again, the issue here is that these companies already have insane valuations. Microsoft trades at nearly 40x earnings. Amazon trades at nearly 60x.

The issue is again, that several companies on the MAG7 list are competing with each other for the same market share. The margins in that market are good. The outlook is strong, but MAG7 already trade at 1/6th of total world stock capitalization and are concentrated primarily in advertising and cloud, two markets that in 10 years, best case, will still only make up 3-4% of the economy.

History shows that competition chases profits. While businesses like oil and shipping are extremely competitive (any boom in profits is usually met with a lot of new market participants), it’s naive to think that these companies will maintain margins forever.

If you exclude AI as a narrative, the idea that MAG7 can be bigger than 3-5% of the global economy seems fantastic. But what if we include AI?

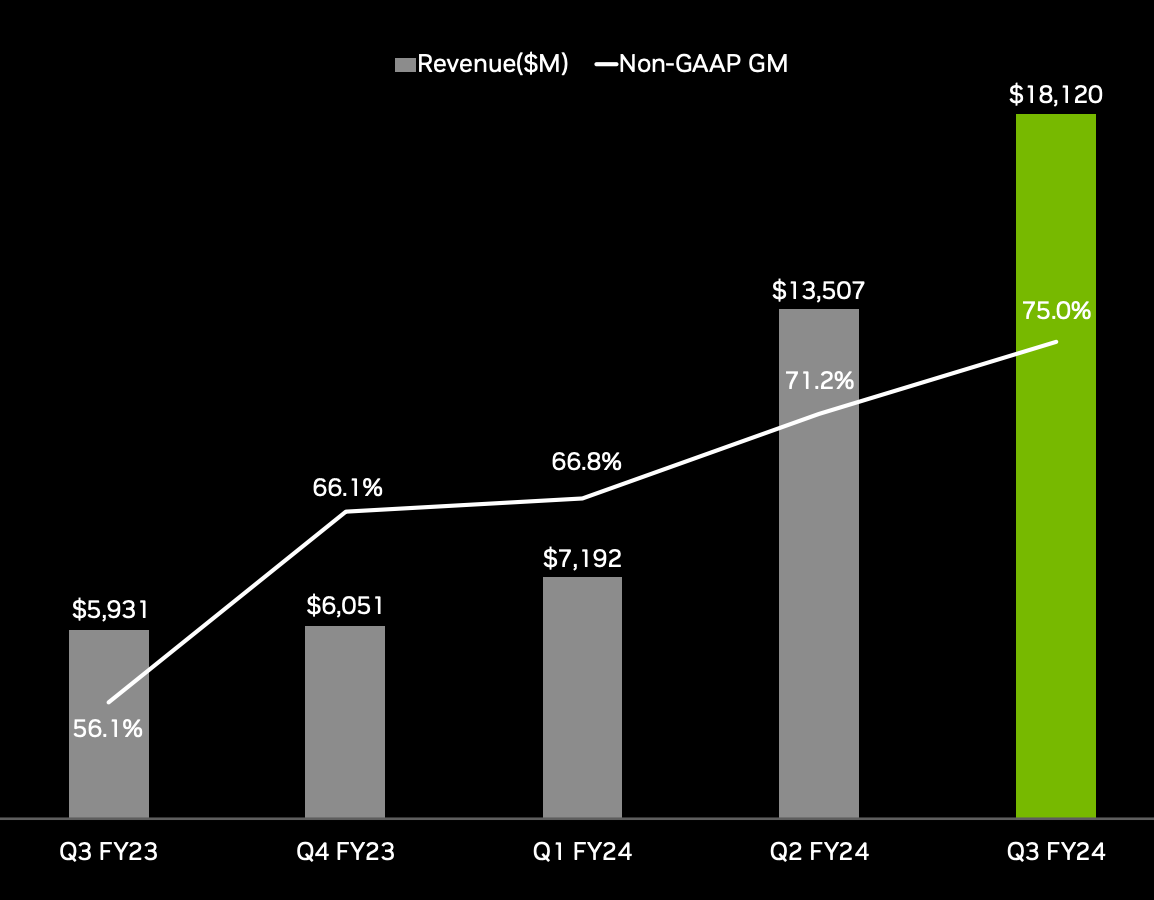

NVDA revenues have exploded, which have resulted in an unprecedented appreciation in NVDA share price. The thing is people believe that general AI is essentially already here (because they’re impressed by an LLM interaction in a chat bot). The issue that I see is that much of the world economy is already highly automated. Very specialized machines pick fruit, pump oil, package products, and assemble cars. The gains that AI can find in “the real economy” are limited. The idea that AI will replace lawyers, doctors, programmers, and other high income earners and usher in a new paradigm is also fantastic. Nearly 70% of the United States GDP is consumer spending. Who do you think the consumers are? The rich ones are lawyers, doctors, programmers, and the like - exactly the people that AI will supposedly replace. But what about entertainment? Can’t AI make movies and write books? Sure, but the entire entertainment sector is only 2.5% of GDP, and entertainers are some of the most highly paid people on earth. What happens to consumer spending if the world’s biggest spenders are laid off and all the cash goes to companies that hoard it on the balance sheet?

Regarding TSLA, the valuation is absurd and so I won’t even discuss it. Long term, it will be valued like a car company.

Anyway, I’ve had an awful start to the year. I’m down 6.5% YTD, with about half of that happening today. If you’ve made some money on the MAG7 boom great for you - but I hope I’ve been able to intelligently push back on the idea that any possible growth in these businesses is already well accounted for by the valuation.

I can buy the argument that these higher margin revenues deserve a premium, but when you have companies that make up 2% of GDP that might be able to get to 5-7% of GDP already trading at 1/6th of total valuation, I say to myself, maybe this is a bubble. The question is, absent a sudden large growth in the monetary supply, with MAG7 and the Nasdaq already approaching 15% and 40% respectively of total world stock capitalization, how much bigger can the bubble really get? What businesses can MAG7 expand into where they will get the kinds of margins that advertising and cloud computing have? How much can those businesses really grow since they must take an increasing share from the rest of the economy?