Market is delusional - but energy dividends will be very real

How I'm thinking about the current energy sell off

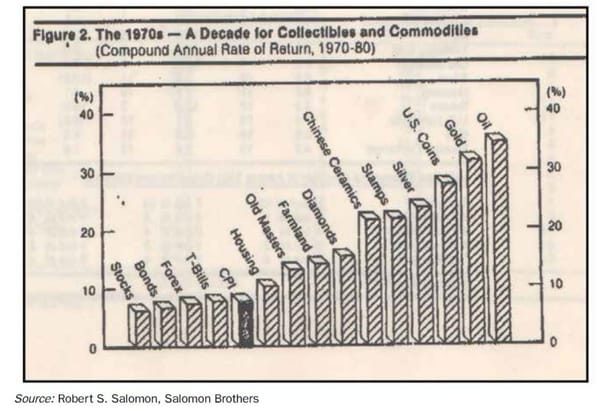

This is going to be a quick, ranting post. The current narrative out there is that inflation has peaked, we’ve entered a recession, and oil is pricing in $50/bbl. Colombia state owned oil company, EC, which just last week paid an $86c special dividend, traded below $10 today. Exxon just last week put out an 8k that effectively guided for billions more in additional profits. Saudi Arabia raised its OSPs (price differentials vs Brent) by record levels (meaning you can’t buy physical oil as cheaply as you can in the paper market). Europe is turning on oil and coal plants as fast as they possibly can. Gas plants with oil backups are switching. Refining cracks remain extremely high. There is every indication that the physical oil market remain extremely tight, and coal is even tighter. Natural gas, while down in the US, is seeing exponential increases in Europe and Asia.

All of this, and yet energy stocks have in some cases sold to covid lows. The entire energy complex is trading like March 2020. Some are now red YTD, and virtually all have given up their post Russian invasion of Ukraine gains. Energy bulls, those who have not been wiped out yet, have either capitulated or are tapped out. Net long positioning in oil is the lowest in years.

So what does one do? For me, I learned my lesson on leverage back in January and have avoided both margin debt and excessive options exposure. I had been selling calls against 20% or so of my net long exposure. Today I capitulated and sold OTM calls against most of my long exposure. My top bets are PBR, EC, and TGA - three stocks that I see yielding north of 30%. Selling 4-6M OTM calls added ~10% to my expected yields, and should my shares get called away, they will get called away above my existing cost basis, on top of the very large dividends I’m expecting to continue from each name.

The best you can hope for is to take profits in the good times and behave defensively in the bad times. I’m still up 28% YTD but as of today have given up about half of my YTD gains. Selling calls against these big yielders was about locking in some additional yield, locking in some of those gains, and raising more cash should the sell off continue.

When I look around, I continue to see no sector of the market with fundamentals like energy. Any short term demand destruction will only result in more consumption. Rig counts across the world remain below pre covid levels. OPEC has struggled to even maintain production, much less increase it. EIA monthly data came out today, and US oil production actually fell in April.

The big picture is that this winter will see huge demand for fossil fuels as Russian gas molecules just won’t be there. I think 3-5M bpd in additional oil demand. Coal will remain bid and probably see a new ATH. As soon as Freeport comes back, US natural gas prices will rise again as Europe and Asia both desperately compete for the same volumes. Regardless of consumer demand destruction, between the war and energy shortages, I just don’t see supply exceeding demand any time soon.

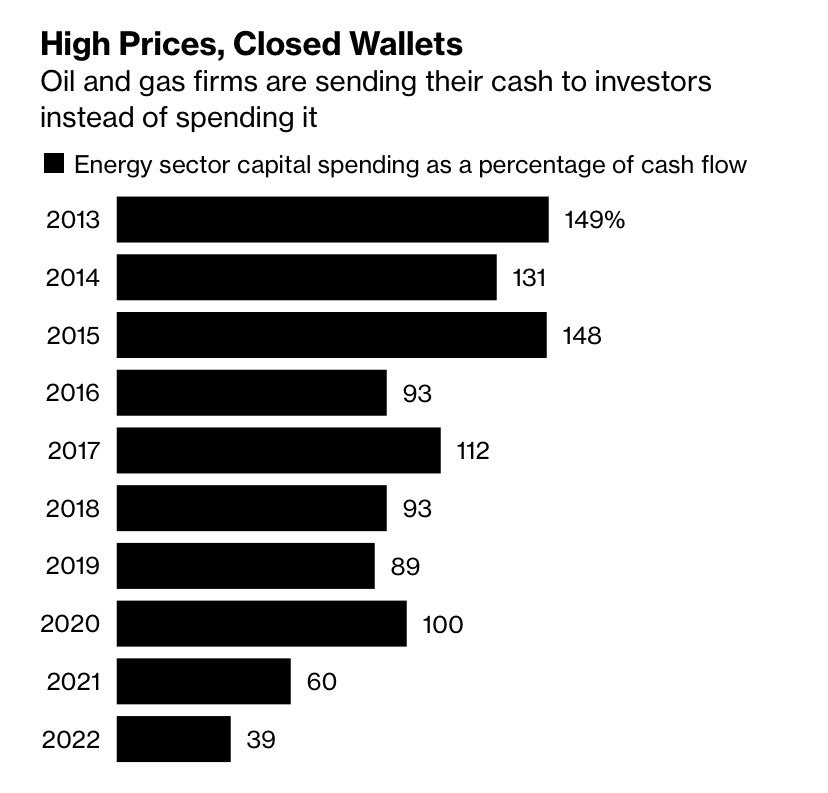

On the corporate side, capex has utterly collapsed (not even keeping up with inflation) and companies are returning more cash to shareholders instead of investing in additional production. It’s not March 2020, and it’s not 2008. You will get paid. You just need to be able to remain solvent in the meantime, and have the ability to add should things get even stupider. Very big yields are coming.

Calvin's thoughts is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.