Plastics - the future of oil

Insight into why all the Middle Eastern oil majors are on the hunt for petrochemical companies

Middle Eastern companies like Saudi Aramco and ADNOC are currently negotiating the acquisition of assets from a number of global petrochemical companies:

- Covestro

- Braskem

- Sassol

- Jiangsu Shenghong Petrochemical Industry Group

- Shandong Yulong Petrochemical

Stakes or assets have already been acquired in:

- OCI

- Borealis

- Rongsheng Petrochemical

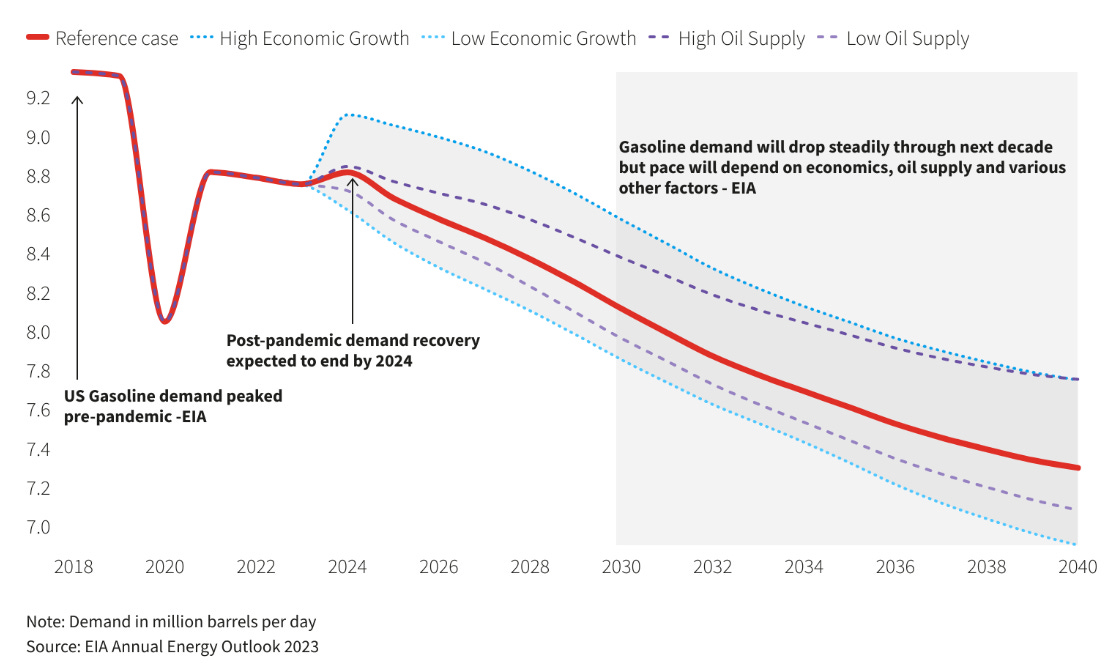

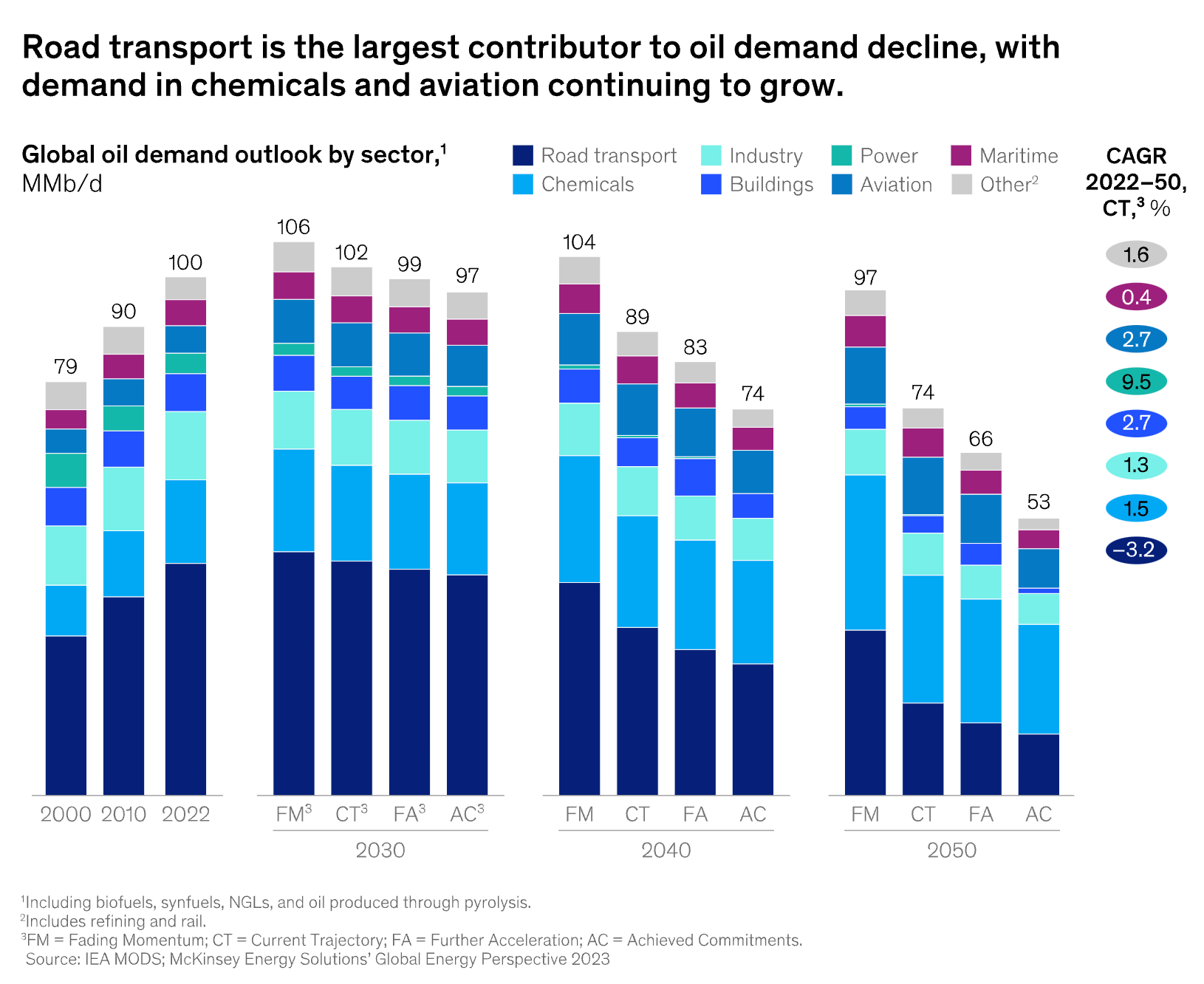

The question is, why are Middle Eastern companies so bullish on plastics? The answer is, they have to be. Long term road fuel consumption estimates are dropping. While shorter term, consumption globally has been resilient, the prevailing sentiment is that eventually, road fuel consumption is largely going to disappear at a consumer level.

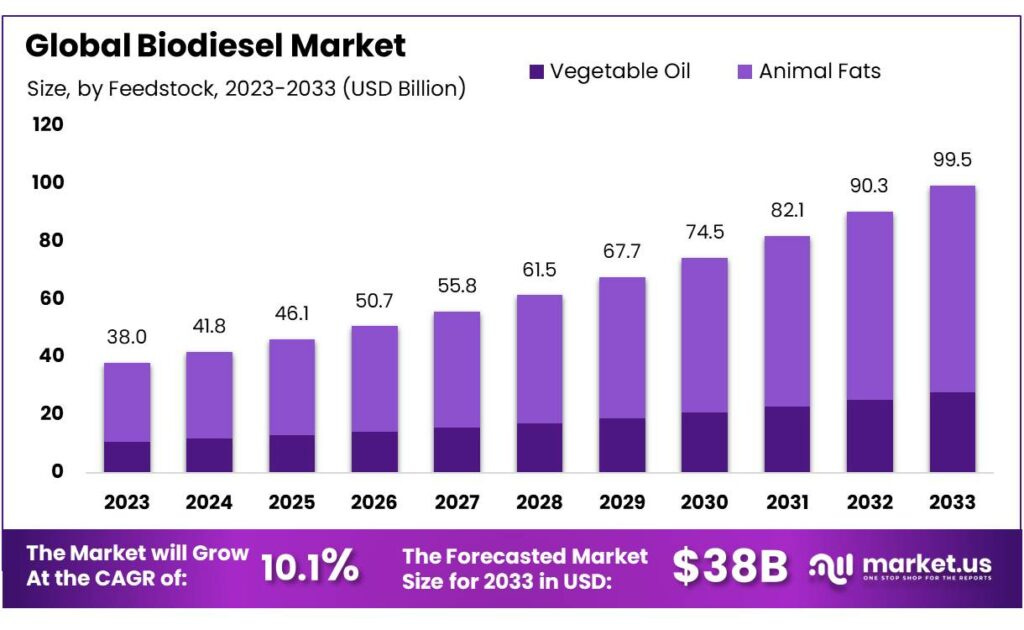

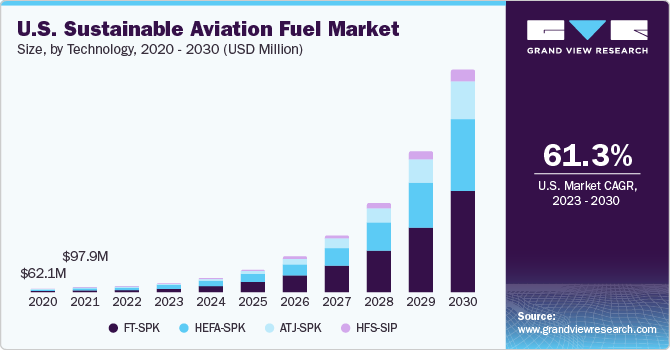

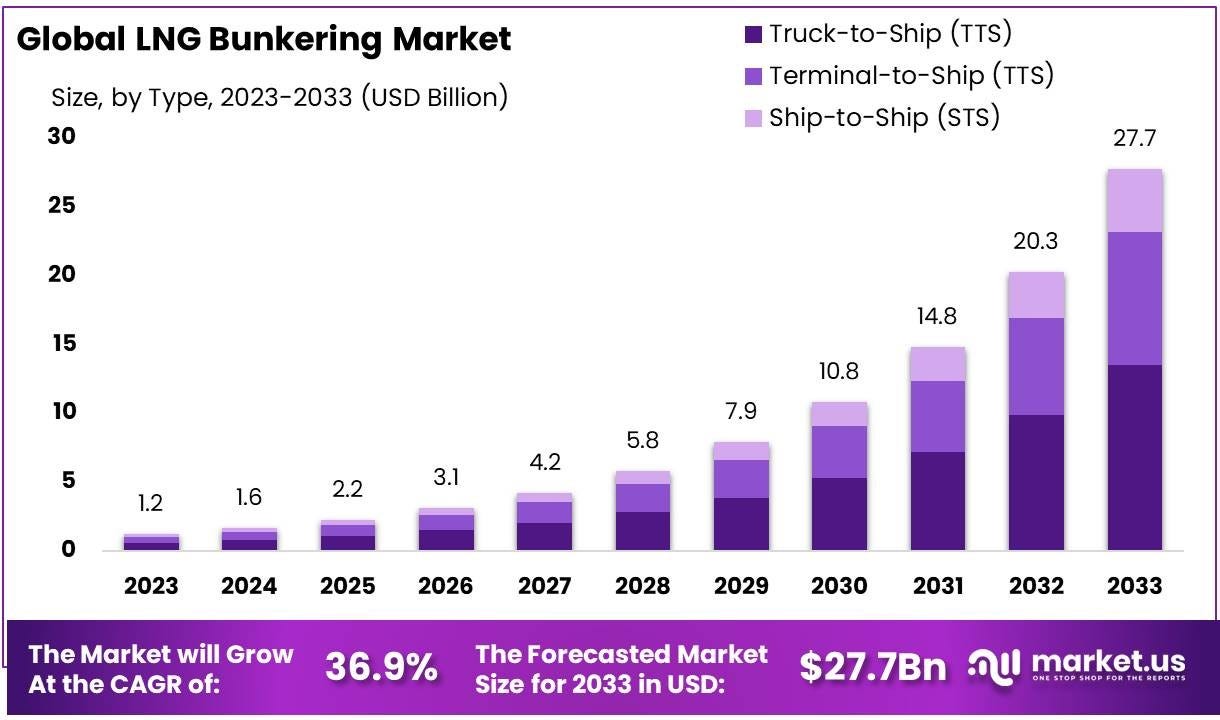

The long term forecasts for diesel, marine, and aviation fuel all look similar - long term consumption of petroleum based fuels dropping, while consumption of “sustainable alternatives” is - according to forecasts, going to skyrocket.

You can take a position on whether or not you believe the timing of the forecasts, but the reality is that many powerful groups are pushing for a reality where neither vehicles, nor ships and planes, use petroleum based fuels for their propulsion systems.

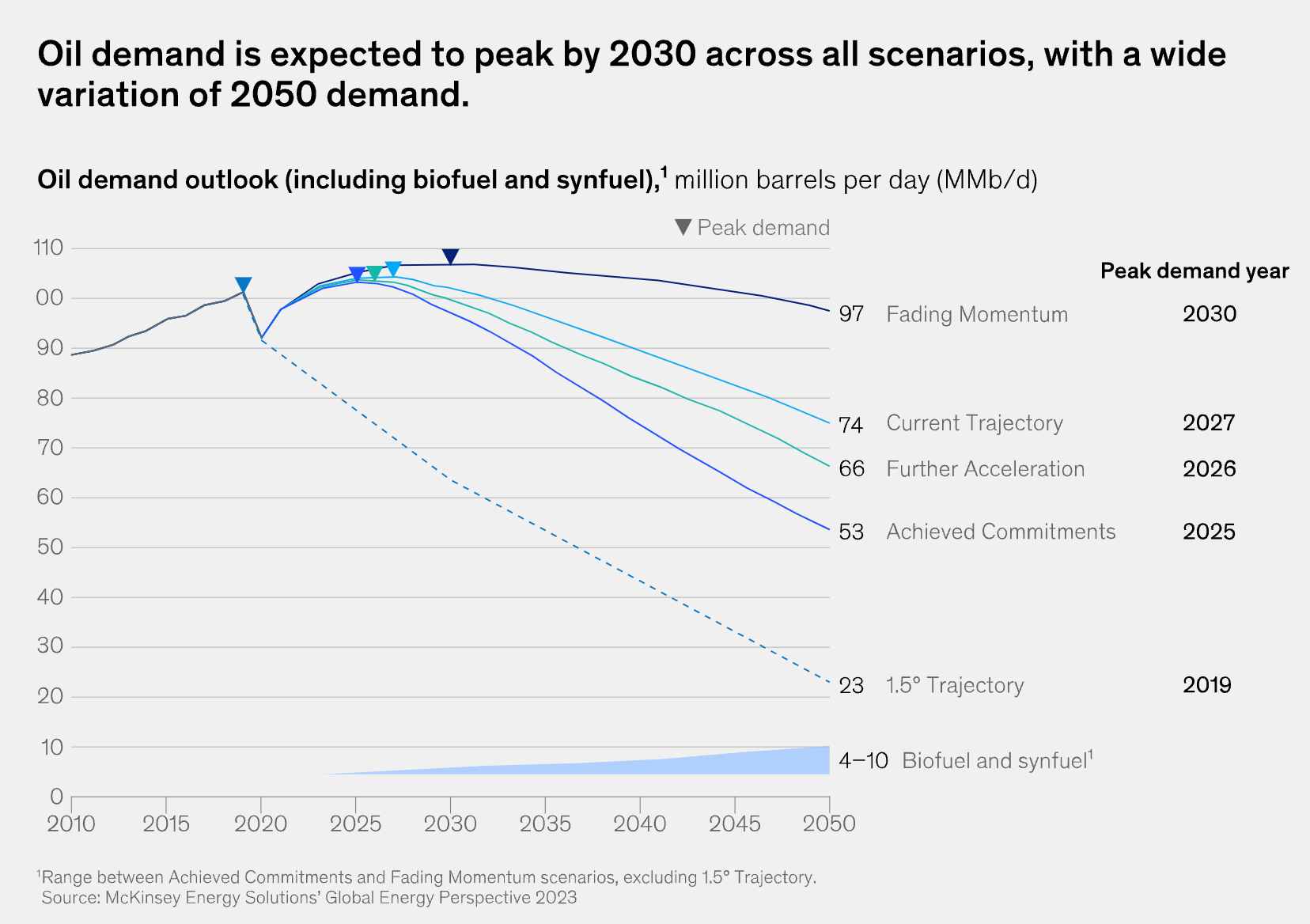

Many studies are predicting peak oil demand to hit in the next few years, like the work below from McKinsey.

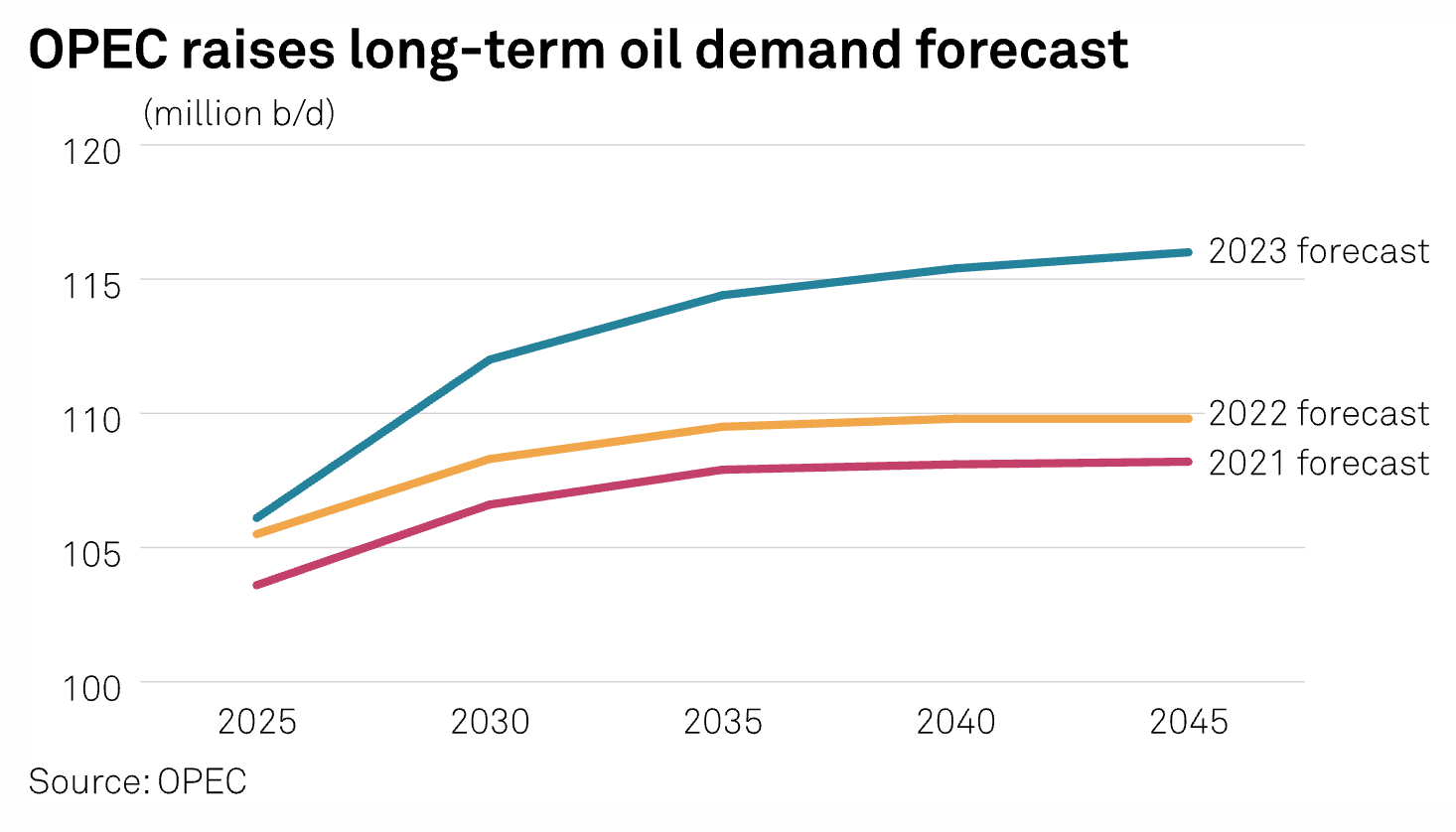

OPEC is meanwhile raising its long term forecasts, departing from nearly all other institutional options on the long term demand for petroleum.

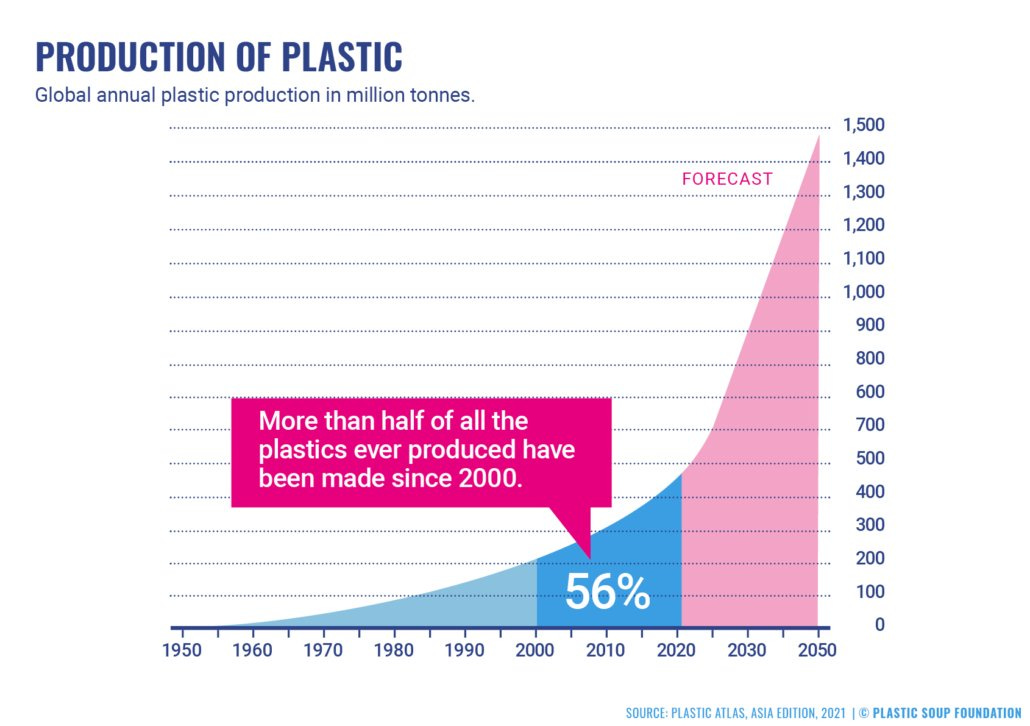

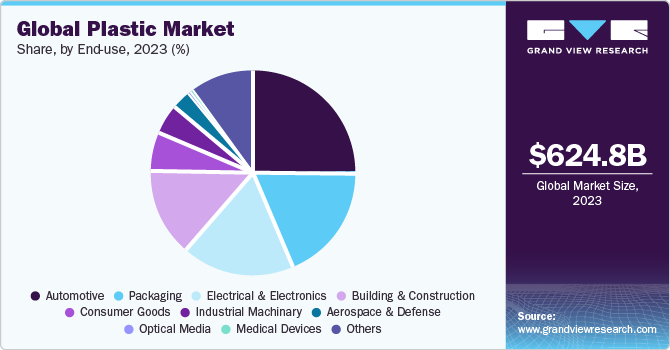

The one case that OPEC, McKinsey, the EIA, and other institutions all agree on peak demand being nowhere near: plastics, i.e the main usage of petrochemicals.

The plastics market today is a relatively small part of global oil demand today, but many researchers believe that plastics will be the #1 demand sector for oil products by as soon as 2040. Considering that oil is the main input in this sector, if other forms of oil demand are vanishing, today’s oil majors, especially the state owned majors who are planning a generation ahead, simply cannot afford to not own that production capacity.

Below are two images, one is a plastics refinery. The other is a fuel refinery. Can. you tell the difference?

Hard to tell a difference, right? Many global oil refineries are decades or even a century old. These are long lived assets which require ongoing maintenance and improvements, but they will be utilized for a very, very long time. Plastics usage is relatively newer than road fuel.

While you and most other market participants are thinking only in terms of a trade you hope to profit from in the coming days, weeks, or months, state owned companies like ADNOC and Aramco - are literally controlled by royal families thinking generations ahead to plan for the survival of their blood lines.

They cannot afford to not own the only oil demand sector which virtually everyone agrees is the only area that will see strong continued growth in oil consumption.

The battery weight issue

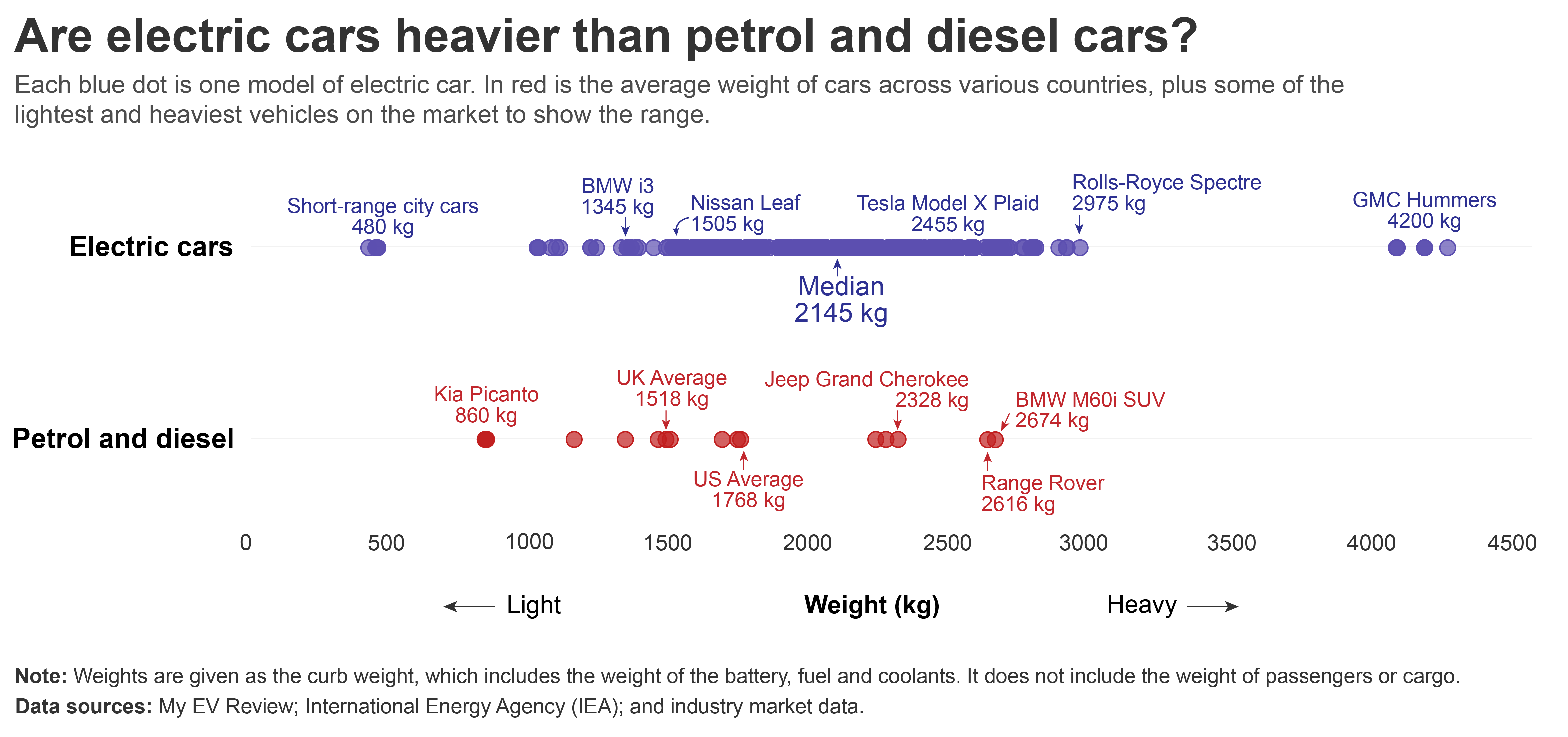

Most cars that are currently on the road globally are ICE vehicles. In order to use less petroleum, ICE vehicles must be phased out in favor of EV, or must at least use a hybrid model. In both cases, large batteries are required.

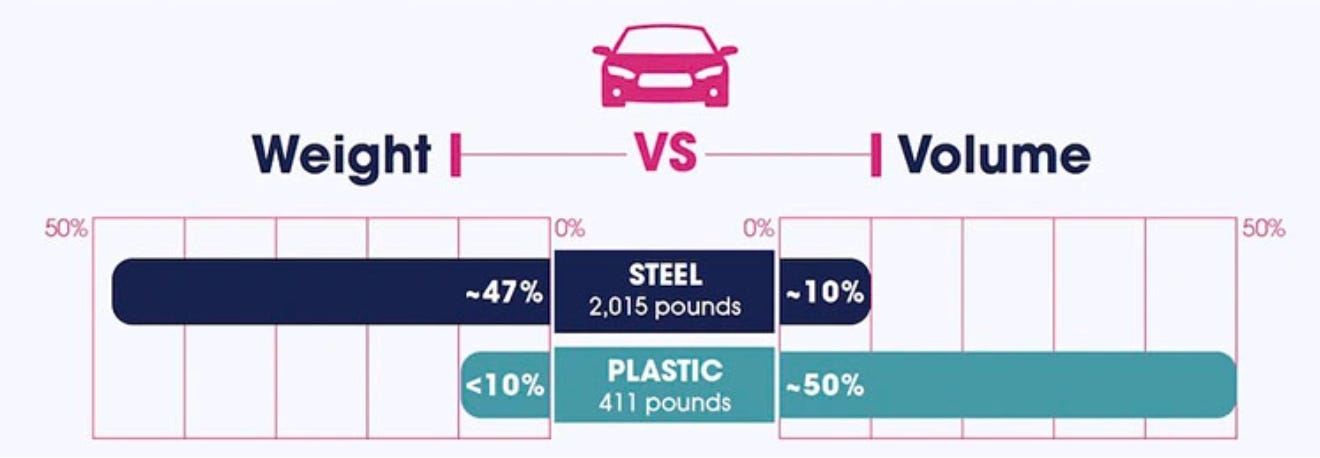

To compensate for the heavy batteries, auto makers have to substitute steel for plastics.

Plastic consumption in auto manufacturing is growing at high double digit percentages per year despite flat production volumes.

3d printing

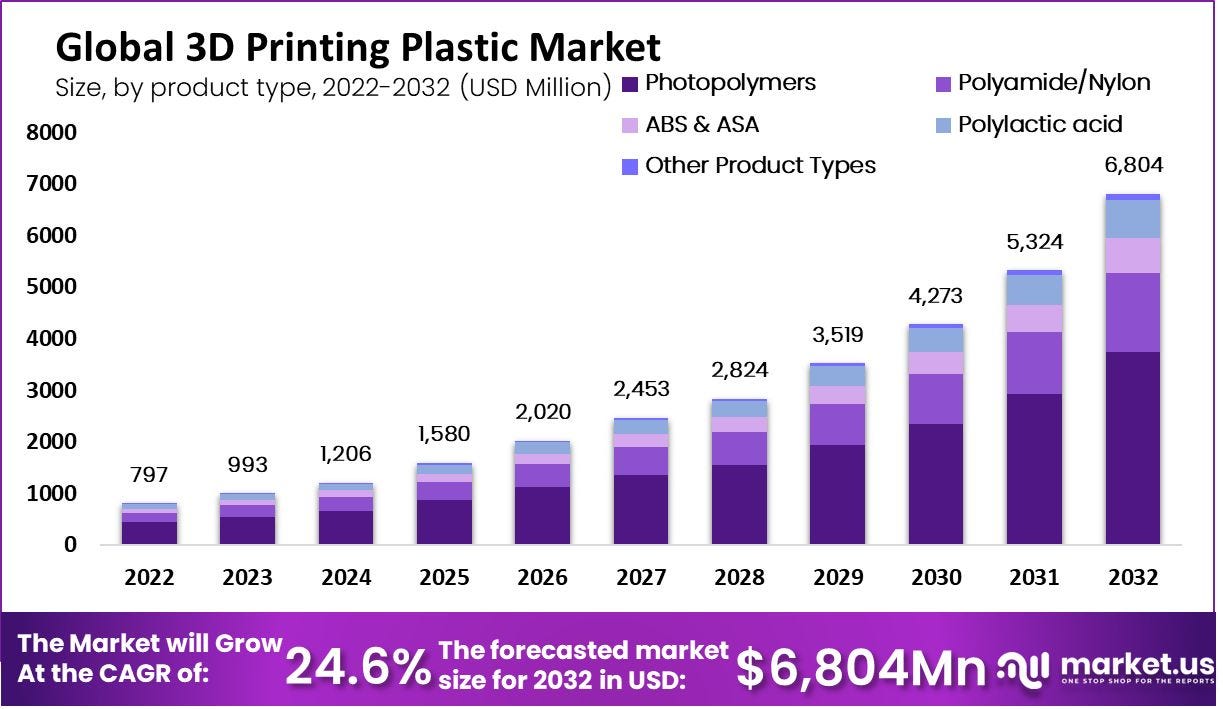

Another demand center in plastics which I think the market fails to appreciate is 3d printing. While currently small, this market is projected to explode - with a very high double digit CAGR estimate.

Yesterday I wanted some coin cases for US quarters. My friend just built a model and printed them out in about 20 minutes with a $300 machine. His workshop is filled with tools and tool holders that he 3d printed. The industry has been around for about a decade, but it’s just now getting to where you can do things at scale with cheap machines fed by a spool of plastic.

Obviously it doesn’t work for everything (some things need to be made of metal), but this is going to be a high growth demand center. Imagine a world where you can print out most of the parts for guns, drones, medical devices, auto replacement parts, and all sorts of other things on demand. This is exactly the sort of disruptive technology that tends to be under estimated. The feedstock for all of this will come from huge petrochemical plants.

Conclusion

While I don’t pretend to be an expert in the plastics market, what’s undeniable is this:

- The richest oil money on earth, who has to think generations down the line, is buying up all the plastics capacity they can, everywhere in the world.

- The entire transition away from ICE vehicles, which every major government on earth is pushing for, is totally dependent on dramatic increases in plastic consumption to pull it off.

- A new transformative technology may see exponential growth in the future, and it uses plastics for feedstocks.

In this reality, what are the long lived “plastics refineries”, the replacement of which would cost billions of dollars, take up huge amounts of land, and spend years just in permitting, really worth? Probably far more than a very short term focused market wants to believe. Follow the smart money here - plastics have excellent long term fundamentals.

Long Braskem!

Calvin's thoughts is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.