Long term planning

I think it's almost a universal rule that given unlimited possibilities, a human being often faces decision paralysis. This is why people that win the lottery so often go bankrupt. For the first time in their life, they feel like they can have anything and everything that they ever wanted. So they go crazy. Houses, boats, cars, even air planes. They spend beyond their means and rack up long term liabilities from property taxes and hired help. Meanwhile, they aren't making a plan around how their capital can sustain them.

The uncomfortable reality that most people don't want to face is that their possibilities are not limitless. As the twilight of age descends, most people are forced into rationality by financial pressures. And most people realize, often too late, that their lifestyle isn't sustainable. They don't cut their spending until they are forced to.

I am currently in the process of negotiating a property purchase with a woman in her mid 60s. She has a duplex, and it is her only form of income. She lives on another property, which she rents, and supports 7 dogs and a horse. I agreed to her purchase price, and she later rescinded it after talking to a financial advisor who told her that there was nothing she could invest the money in to replace her income level. She is living with no margin for error on her current income level. She needs risk free yield, but she also needs appreciation, in order to have a chance on surviving future possible inflation with her current level of capital. It's tough to negotiate with someone who is in an inherently unstainable dynamic, even though you know that one day they will be forced to make hard choices.

People today are facing an incredibly uncertain future. On the one hand, you have the specter of long term unemployment rising due to increased automation, with even previously "safe" white collar jobs at risk, and on the other hand the possibility of monetary debasement seems extremely high due to the balooning social obligations that developed countries face - due largely in part to the deflationary dynamics of AI and automation. The possibility of long term stagflation - where we have both rising input costs and high unemployment / low growth, is a real possibility.

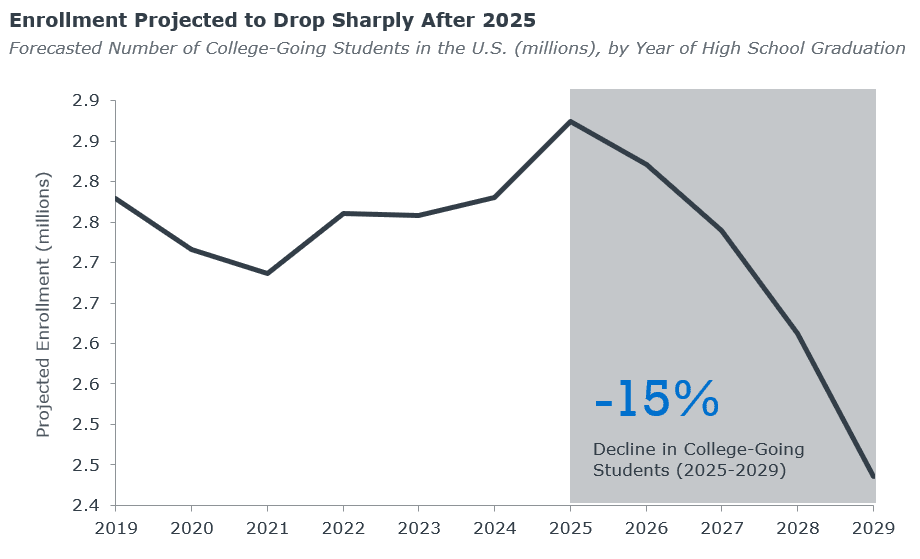

Here's an interesting chart from EAB, a company that provides research, technology, and advisory services to support K-12 schools and higher education institutions, that highlights the demographic challenges we're facing.

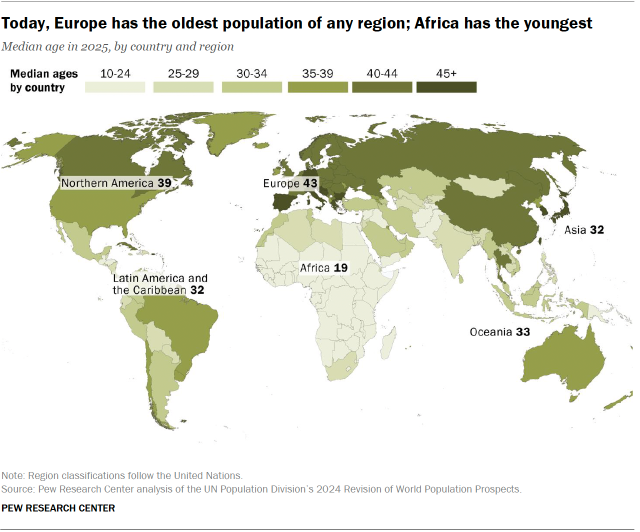

Due to falling birth rates and generational clustering, and birth rates which crashed after the 2008 Financial Crisis, the number of projected college freshmen over the next 4 years is forecasted to decline by 15%. Combine that with falling immigrant populations, and a growing number of baby boomer deaths, and US economic growth looks like it's sitting inside alligator jaws - and the picture for the US is much better than the picture for other developed economies.

How the heck do you hedge a long term picture where resource scarcity meets long term demographic decline? The US population might actually decline in 2025 for the first time ever. Simple math, approximately 3.6M births, 3.1M deaths in 2024. In 2025, we will have fewer births, more deaths, and net migration.

It's really damn hard to grow an economy when demographics turn negative, and the hardest part is that like the lady I mentioned at the beginning of this article, the median level (meaning the center of the data cluster, the average is skewed higher by a small number of very rich people) of retirement savings for people in the 55-74 age group is only around $200,000. These people cannot afford to stop working in an environment where the prevailing narrative is that they will be unemployable due to advances in AI.

The demographic catastrophe is creating this under current that is driving the current investment psychology - and you can believe that the central planners are aware of how bad the demographic outlook is. The current mindset is I have to ape everything into lottery tickets, because under no under scenario do I have enough to retire on. The current speculative mania in financial markets is only partly driven by greed, the other major driver is pure financial reality - most people are realizing that their employment prospects are dwindling at exactly the same time that income and growth prospects in the real economy are shrinking. This explains the psychological investment in big tech - things like AI must work because otherwise, who will take care of an aging population that hasn't saved enough for retirement?

Just due to demographics, it's almost certain that American residential real estate will take a trajectory that looks something like commercial real estate, though possibly not as severe since you don't have the de-urbanization phenomenon due to e-work. This means that retirees who are dependent on HELOCs and rental income will be increasingly squeezed.

The Trump administration treating a continuous rise in the stock market as a national priority isn't just greed and grift (though that's a lot of it), it's a symptom of Americans approaching an increasingly imminent demographic cliff with the attitude of bringing future pricing to the forefront, because the future looks bleak.

Thus, the bull narrative, and the ability of an entire generation to survive retirement, not to mention the future prospects of Gen Z and Millenials, now hinges on the following:

- AI is real

- AI will result in a productivity revolution

- AI will drive down costs (mostly from efficiencies and labor savings)

- AI will be able to figure out any physical constraints (such as resource shortages or power limitations)

- AI won't just kill us after we give it full autonomy over the economy

The unmistakable reality, however, is that even if the aforementioned bull case plays out, it represents a fundamental change to our underlying economic model. AI "working" means fewer people at all levels of society are employable. Higher unemployment in formerly white collar jobs as well as entry level jobs means more people entering career paths that are currently viewed as "safe" - such as plumbing, electrical work, welding, etc. - and driving down wages in those areas. The other anaconda grip pressure on the national situation is the structure of our federal spending. National defense, for years the #1 expenditure, is now #5, behind interest, and far behind social security (retirement) and Medicare/Medicaid (28% combined).

- Social Security: 23%

- Medicare: 14%

- Health (including Medicaid): 14%

- Net Interest: 14%

- National Defense: 13%

65% of our budget is going into social costs and net interest. Now if you assume AI "works", what happens to payroll income tax, which is already below payable benefits? The social security benefit cliff - the point at which the social security trust - which currently pays the difference between social security tax income and social security benefits - goes to zero - is 2033-2034. This means a mandatory cliff drop in benefits - at least 25% - in less than a decade.

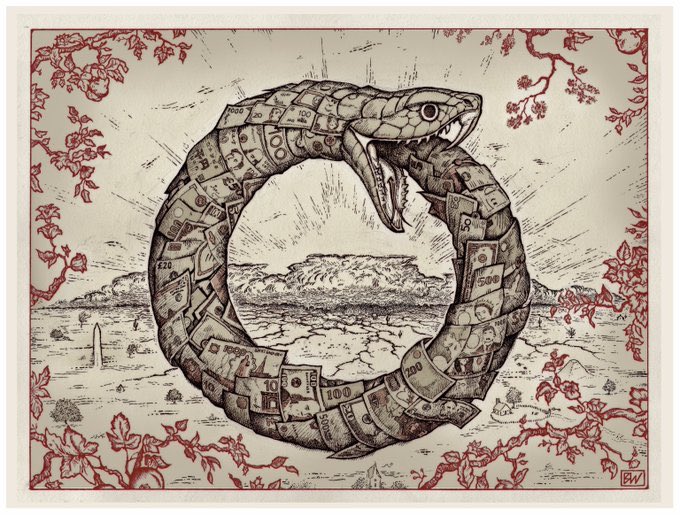

The image of the snake eating its tail is inescapable. The only way to stem the bleeding on the fiscal side is to increase taxes or cut spending. Cutting spending is impossible because the top 5 spending categories make up ~80% of the budget. So we are doing long shot investments into AI, crypto, and quantum computing, which if they work, AI kills income tax receipts, making more social subsidies - the very pressure driving all this unsustainability - even more prolific, and if quantum works, it kills crypto, which we're now told is a possible mechanism for saving the dollar. Meanwhile, retirees still need income, in a world where both the demographic pressures (slowing population growth) and the ability of the population to generate income may dramatically deteriorate due to AI.

These realities are all sobering to think about, which is why almost nobody talks about them, and also why everyone is dancing before the music stops. We all have at least a dim sense of what is coming. Everyone is all in on the tech because the walls are closing in and the moon shot seems like the only hope. We don't have the answers to the financial problems or the demographic cliff so we're throwing money at tech companies in the hope that somebody smarter - in this case - a benign and magnanimous super intelligence - will figure it out.

The inescapable truth is that the current economic model is running out of track. Tax revenues are not sufficient to fund social commitments. Tax increases that put even more of a burden on individuals will be deeply unpopular. Corporate tax increases crash the stock market. If AI works, revenues will be concentrated in the hands of a few mega corps, whose "winner take all" prize will effectively be to subsidize the billions of people dependent on the previous economic model which they just upended, which of course, leads you to question valuations.

While we've discussed the many deflationary pressures from debt, fiscal cliffs, and AI crashing wages, we haven't even touched on the possible inflationary pressures which drive the overall stagflationary narrative.

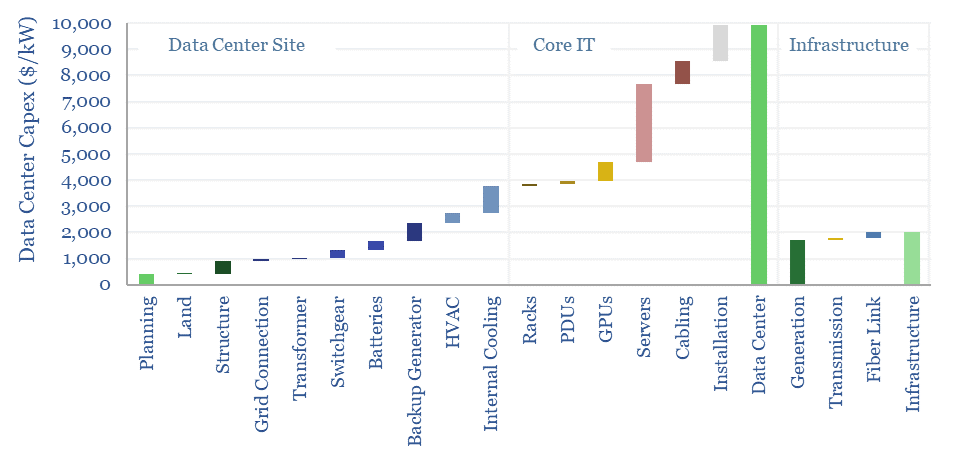

Current projections are that the Fed will end basically fake QT (sure, they shrank the balance sheet, but M2 still grew), and move back to outright QE. This, again, is driven by objective realities. At 14% of the budget going to interest expenses, we're effectively where Argentina was at a decade ago. Interest rates need to be surpressed. This will almost certainly take the form of yield curve control (i.e. the Fed bidding up long term bonds and pushing down the US government financing cost). With the Fed's balance sheet growing, this will mean even more money supply growth. AI / data center capex will also concentrate a lot of buying in construction, electronic equipment (copper, silver, rare earth metals, tin, etc.) as well as use a lot of water and electricity.

This will mean that now unemployed consumers will now see cost of living inflation, at least on the utilities side, while the costs of building anything that involves data center raw materials (i.e. metals, concrete, and other building materials) also cost inflate.

This could be good for utilities and commodity producers - but again, we have to step back and ask - what the hell is the point? Who are we building all of this infrastructure for? What purpose will it serve to humanity? What will the returns look like if every major tech company and PE firm is all putting money into effectively the same investment, especially when OpenAI, the flag ship AI implementation, is still hemmoraging money?

If AI works, we get millions of unemployed consumers who are grappling with rising cost of living combined with failing state capacity to support them. This then puts more of an onus on big tech monopolies to pay more taxes and do more to support the society they are displacing, but since they are all investing in the same thing, it might actually be a race to the bottom where they end up burning through their cash piles and loaded with debt to win a final war in which there are no survivors - similar to how Chinese industrial companies added so much capacity that they made entire economic sectors essentially non profits.

Again, my question is where the hell are we even going, and how in the world are we going to support 73 million baby boomers in retirement?